Why Mini's Newest Content Play Could Seduce Young Chinese Drivers

Plus: Tiffany's new lease on life, Chanel's not-so-dangerous liaison, and Bilibili cracks down.

The Content Commerce Insider newsletter highlights how brands create content to drive revenue. If you have received our newsletter from a friend or colleague, we hope you will subscribe as well and follow us on LinkedIn and Instagram.

The coronavirus-fueled restrictions on travel have had a huge impact on the global tourism industry, but in China, where the spread has largely been brought under control, the reopening of society has been accompanied by a growing interest in domestic travel. Tapping into this trend is the BMW-owned British auto brand Mini, which recently partnered with production company Xinshixiang to produce “Two Days Away” (出逃两日又如何), a branded travel documentary series airing on Tencent Video.

“Two Days Away” follows in the footsteps of successful custom content such as Airbnb’s “Adventure Life” (奇遇人生), which also appeared on Tencent Video, featuring a celebrity-heavy cast of guests that included acting couple Yuan Hong and Zhan Xinyi, along with Lisi Danni and Shen Mengchen, both of whom recently appeared on the summer hit “Sisters Who Make Waves.”

The show uses the theme of freedom via road-tripping to appeal to the pent-up demand for new experiences that has been part of China’s post-Covid consumer recovery story, while simultaneously exploring the dynamics of different types of relationships in the process (husband-wife, father-son, best friends, etc.). And although the Mini brand may not yet be affordable to the young target audience of the show, the series creates a resonant brand story while encouraging viewers to forge their own unique paths through life and rethink how they can uphold their ideals.

The program is part of Mini’s broader China expansion, which includes plans to expand its electric vehicle lineup to start production in China in 2023, with the production of two new SUV models through a Chinese joint venture that will be exported to overseas markets including the United Kingdom.

The brand has previously used a content-commerce strategy to reach the future generation of auto buyers. In March, Mini collaborated with Bilibili (Gen Z’s favorite video streamer) on a 24-hour livestream that followed popular creators on the platform as they embarked on a short camping trip. The livestream gave viewers — many of whom were still stuck at home as China was just emerging from coronavirus lockdowns — a chance to see the experience of driving a Mini while participating in interactive gameplay and giveaways.

- by Ginger Ooi

Mentioned in today’s newsletter: Alibaba, Bilibili, BMW, Chanel, Douyin, iQiyi, Kuaishou, LVMH, Mini, Richemont, Tencent Video, Tiffany & Co.

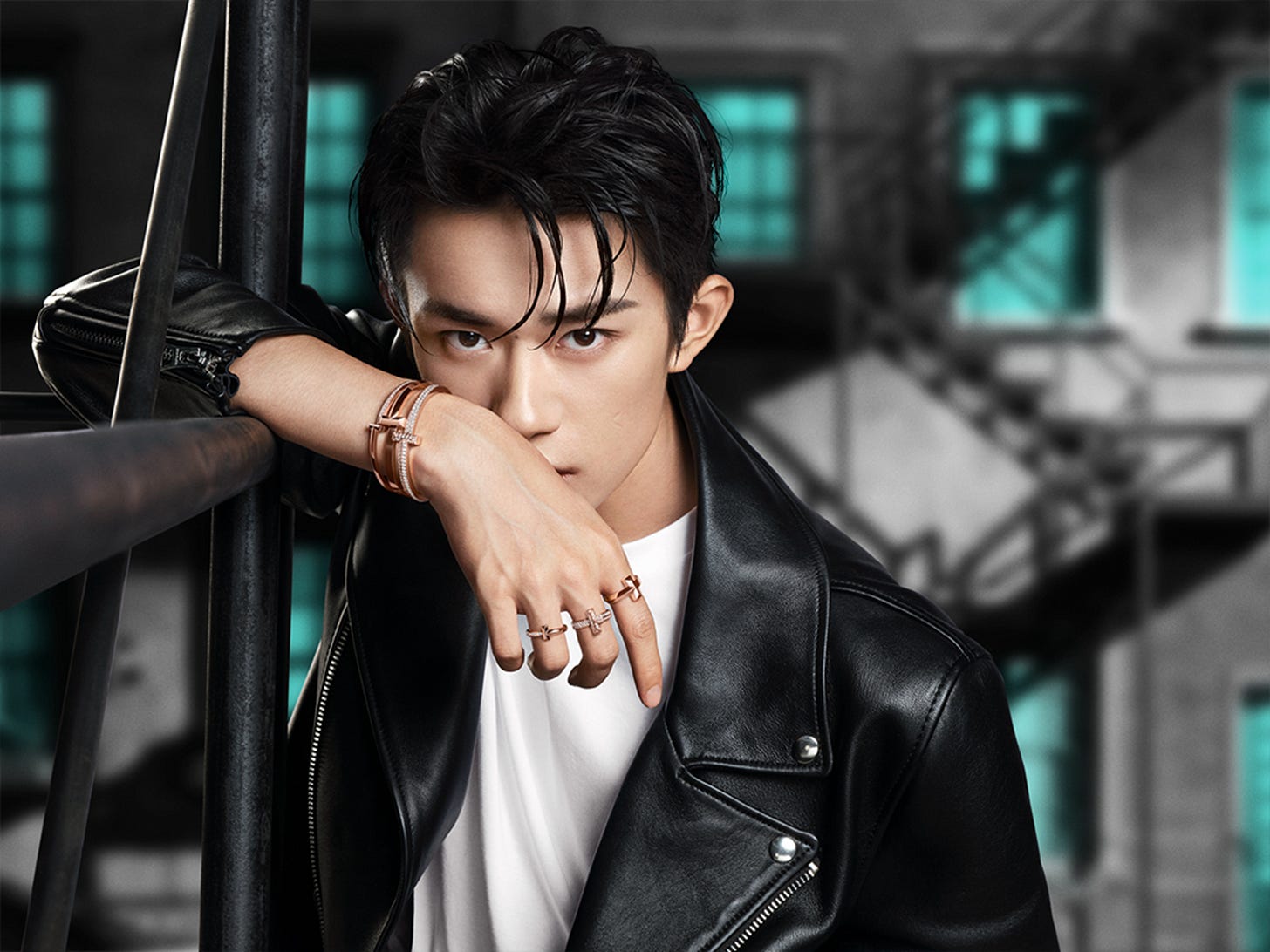

Tiffany & Co. Could Have a New Lease on Life in China

by Avery Booker

Just a few months ago, it looked like the American jewelry mainstay Tiffany & Co. could be in store for a tough end to what’s been an already very challenging year for luxury. The brand’s much-publicized acquisition by LVMH, first announced in late 2019, appeared to fall through in September when the French luxury group sought to break off the deal, kicking off a series of intense negotiations until LVMH ultimately said it would go ahead with the purchase at $131.50 per share. ($3.50 less than previously agreed, valuing the acquisition at $15.8 billion.)

For all of the drama that surrounded the deal, the motivations that drove LVMH to purchase Tiffany in the first place were driven in no small part by the Chinese market. The purchase would allow LVMH to beef up its impressive brand portfolio with a company favored by middle-class and younger consumers, while also expanding its accessible jewelry and timepiece offerings — giving it some competitive advantage against rival Richemont, which is more focused on hard luxury. As Nikkei Asia reported, “For LVMH, buying Tiffany would bolster its watches and jewelry segment, which now generates less than 10% of its total revenue — far less than the likes of the rival Richemont group, whose brands include Cartier.”

As 2020 comes to a close, Asia’s relatively strong consumer recovery — and China’s in particular — is seen as a major factor in LVMH’s decision to complete the deal. The timing of the acquisition couldn’t come at a better time for Tiffany, which is looking to cement its position inside China as its consumers are spending far more domestically with international travel sharply curtailed.

Read the full article on Content Commerce Insider

Brand Film Pick: Vogue China Brings Out the Big Guns for Chanel

French luxury stalwart Chanel may continue to largely resist the acceleration to online retail that is transforming the rest of the industry, particularly in China, but it still relies on digital channels to help tell stories that can build its brand across the consumer spectrum.

The storied fashion house has been involved in film content from its earliest days, when Coco Chanel served as costume designer for movies such as Jean Renoir’s “The Rules of the Game,” and made significant moves into branded content under its longtime creative director Karl Lagerfeld, who directed numerous short films revolving around the life and mythology of the brand’s founder.

Chanel’s latest production was created as part of this year’s Vogue Film event, the last under Vogue China’s founding editor Angelica Cheung, who recently announced her departure from the publication after 16 years. Since 2016, Cheung spearheaded the effort to bring together top directors and A-list stars to produce high-quality fashion films, and her final act brought together two of China’s biggest stars, Wang Yibo and Zhou Xun, for the eight-minute “Le Vrai Ou (花的游吟), directed by Zhou Quan.

The film is a brief vignette of the winding down of a liaison between a middle-aged lounge singer, played by Zhou Xun, and a young bartender (Wang) bound for school overseas. Zhou sings a classic Chinese song for the audience as she and Wang’s character reminisce about their time together. The Chanel brand is nearly imperceptible, merely hinted at in the sleeve of a tweed jacket or a white flower atop a cocktail, but the film’s ambience of romance and intrigue, with much left unsaid, establishes an aura that ties to the brand’s heritage that was easily amplified by the social media presence of Vogue China and the film’s stars. (Especially Wang, who has 36 million followers on Weibo and has signed dozens of brand endorsement deals.)

News From China

The youth-oriented video streamer Bilibili’s latest investments in content are creating stronger ties between the platform and the film industry.

Last week, Bilibili announced that it was planning four animated productions for theatrical release as part of its 33-project anime slate, and it is also bringing more studio pictures to its audiences, with recent hits such as women’s volleyball blockbuster “Leap” (夺冠), starring Gong Li, appearing exclusively on the platform (part of a broader deal with Huanxi Media) and following other major 2020 releases such as “The Eight Hundred” (八佰) and “Jiang Ziya” (姜子牙).

And rather than just serving as a venue for watching any particular film, the platform is capable of creating a strong sense of community around its releases, thanks to its popular “bullet chat” feature of on-screen commentary from viewers, and by hosting supplementary content such as interviews with stars, music videos, and livestreamed launch parties.

Bilibili was also a supporting sponsor of this year’s Golden Rooster Awards, mainland China’s biggest film prizes, and it announced its latest film initiative during the event.

Partnering with filmmaker Ning Hao and his Dirty Monkey Films, Bilibili aims to support young directors in the production of 30 short films that will be distributed on the platform, with opportunities for top performers to be adapted into other formats such as feature-length films, anime, and games.

Bilibili also plans to get in on Dirty Monkey’s existing project to support emerging filmmakers, the “72 Transformations Film Project,” which has already drawn acclaim for movies such as 2018’s “Dying to Survive” (我不是药神).

Bilibili’s strong content orientation provides more opportunities for brands, for example through its upcoming lineup of reality programming that covers niche interests such as hip-hop, voice acting, and trends in science and technology, or by launching brand accounts with content that is specifically tailored to the platform’s predominantly Gen Z audience, such as BMW’s recent meme-filled animated video.

Last week’s announcement of new restrictions on both entertainment and e-commerce livestreaming from China’s National Radio and Television Administration has been met (understandably) by expressions of support from some of the biggest players in the business.

Alibaba CEO and chairman Daniel Zhang welcomed an increase in regulation, calling it timely and necessary, and vowing that the company would set higher standards for itself, while top e-commerce livestreamer Li Jiaqi (who has himself been called out for gaffes in the past) said that sellers must answer to consumers and strictly supervise their teams.

Platforms are also taking quick action to tighten the reins on their livestreaming content. Douyin announced that it would crack down on “low-quality” sales broadcasts that hype up products in an unseemly or illegal manner, while Kuaishou is limiting the frequency of pre-sale teasers that hosts can air.

Meanwhile, Guangdong province has banned the distribution of mukbang-style videos, part of a broader nationwide campaign against food waste, while netizens are debating the implications of a potential ban on livestreaming by “immoral” celebrities who have been caught up in scandals.

Jing Culture & Commerce has released the first extensive report to focus on livestreaming in the context of cultural institutions. Covid-19 has radically impacted how cultural institutions around the world engage audiences and livestreaming is emerging as an increasingly vital tool. The report presents four key case studies from 2020 (British Museum, Palace of Versailles, UCCA Beijing, and the National Museum of China) that showcase the dynamic application of live video.

In addition, the report draws from industry insights to offer tips and actionable steps for organizations considering integrating livestreaming within existing strategies.

News in English

Alibaba and Tencent have both had talks with Baidu about acquiring a controlling stake in video streamer iQiyi, although sources say they have balked at the $20 billion asking price. Reuters

Chinese media reported that rivals Kuaishou and Bytedance have been looking to enter the group-buying e-commerce sector, although the latter has since denied the reports. KrAsia

Multi-channel network Ruhnn Holding is the latest U.S.-listed Chinese company planning to go private, just a little over a year after being listed on Nasdaq. Caixin

Chinese social media has been abuzz amid rumors that Alibaba plans to shut down its music streaming service Xiami, which, though smaller than competitors from Tencent and Netease, has millions of fans. Pandaily

With a focus on culture, heritage, and history, Baidu’s Treasure China app puts a more sophisticated spin on livestreaming, and can be used to promote commerce in a more subtle and engaging manner than the typical sales broadcast seen on rival platforms. Dao Insights

Mango TV’s hit summer reality show “Sisters Who Make Waves,” which featured a cast of established female celebrities over the age of 30 competing to win spots in a musical group, won top program of the year at the 2020 China Video Awards. China Daily

WPP’s David Roth discusses the rise and evolution of e-commerce livestreaming, luxury’s digital dilemma, differences between Singles’ Day and Black Friday/Cyber Monday, and more. Alizila

To win in China, luxury brands must adopt a hybrid approach that combines digital transformation with offline retail initiatives that can support storytelling and the establishment of emotional connections with consumers. WWD

The key drivers of luxury consumption among young Chinese are materialism, individualism, and social competition, according to a study by the Chinese University of Hong Kong and the University of South Carolina. CUHK

A review of key differences in WeChat mini program functionality available to Chinese entities versus overseas firms. Azoya

iQiyi’s virtual group, Rich Boom, made its overseas debut at the MTV Video Music Awards Japan, and the streamer has been seeking out a slew of branding and commercial opportunities for IP of the band and its characters. PR Newswire

The snack producer Three Squirrels was one of China’s first internet-famous brands, and relying heavily on content and IP to drive its growth, though that’s has come at a price that may not be sustainable. KrAsia

We’ve Got China Covered

China Film Insider: Sports Film “Leap” Won Big at the 33rd Golden Rooster Film Awards

Jing Daily: Can China’s E-commerce Platforms Save Italian Goods?

Jing Culture & Commerce: Spurred by Covid Lockdowns, Museums Bring Virtual Content Into Broader Play