We Asked Industry Leaders To Predict 2021 Content Commerce Trends

Plus: Will the West Catch Up With China’s Social Commerce?

The Content Commerce Insider newsletter highlights how brands create content to drive revenue. If you have received our newsletter from a friend or colleague, we hope you will subscribe as well and follow us on LinkedIn and Instagram.

The coronavirus pandemic forced just about every major brand to revise 2020 goals and restructured them to face the “new normal.” As the world shifted to living predominantly online while spending a great deal more time at home, the internet became the most critical medium for brands to connect to consumers, leading to an acceleration of the digital commerce trends that had already been underway. For context, the New York Times reported that the United States took eight years to grow e-commerce from 5% to 12% of retail sales, but it only took 12 weeks (from March and June 2020) to go from 12% to 16%. Today, there are more than 4.66 billion people using the internet, representing more than 59% of the global population.

Online content commerce has thus seen a seismic shift in its significance, with the rising focus on livestreaming, gaming, and short-form videos, as well as lots of crossover collaborations, enabled by the connected nature of social media. Meaningful brand storytelling was already gaining importance prior to 2020, but has gathered further traction due to the pandemic, and brands have been spurred to offer both material support along with alignment of their values towards current social issues, from activism to praise of healthcare workers.

So, where will 2020’s surge of community spirit, video content, social media usage, and e-commerce sales lead us? We asked experts for their predictions of content commerce trends to look forward to in 2021.

1. Enhanced Intimacy

Named one of Forbes most influential CMOs, Ana Andjelic is author of The Business Of Aspiration: How Social, Cultural, and Environmental Capital Changes Brands. Andjelic says, “The keyword of 2021 when it comes to content and commerce is P Commerce, which stands for personal commerce. Personal commerce is the antidote to Amazon and already exists in Shopify’s Handshake marketplace and also on Instagram, where mostly direct-to-consumer brands put their human face first — we know all about who they are, what they like, what they do in their free time. It’s making shopping personal again versus transactional.”

In agreement that brand marketing will be increasingly personal, Pandaily’s TechBuzz China co-host Rui Ma says that we are likely to see more top executives taking on the role of influencer. “I’d probably expect even more top CEOs and celebrities to get involved in livestreaming and short-form video. Especially for the CEOs, when done well it seems to be such a high ROI on generating publicity and building trust with their consumers.”

Saisangeeth Daswani, head of advisory (fashion, beauty & APAC) at trends intelligence company Stylus, adds, “As we see more brands leverage social media and instant messaging to establish intimate connections with consumers in the West, many will dedicate a larger portion of their sales and marketing budgets to enable direct dialogue with consumers and to create compelling commercial hooks within these avenues. The learnings from these intimate interactions will also allow brands to better curate their product and content offering across platforms, while providing more intimacy and personalisation to the growing cohort of at-home shoppers.”

2. Virtual Worlds

“The increased sophistication of virtual environments and rising numbers of online audiences in virtual platforms created a collection of new opportunities in the growing metaverse (virtual spaces where people can interact with each other and brands),” says Daswani. “The overwhelming response and reaction of ‘Animal Crossing: New Horizons’ is a perfect example of this.”

And for 2021, the movement is evolving: “As 5G becomes more prevalent, so will the demand for more interactive and immersive experiences, which the gaming landscape is primed for,” Daswani explains. “Additionally, as consumers increase their time spent in the metaverse, their digital doppelgangers may become even more important than their physical selves. Content creation for virtual worlds will be a priority and will move from facilitating interactions to transactions, fuelling the growth for G-commerce in 2021.”

3. Social Commerce

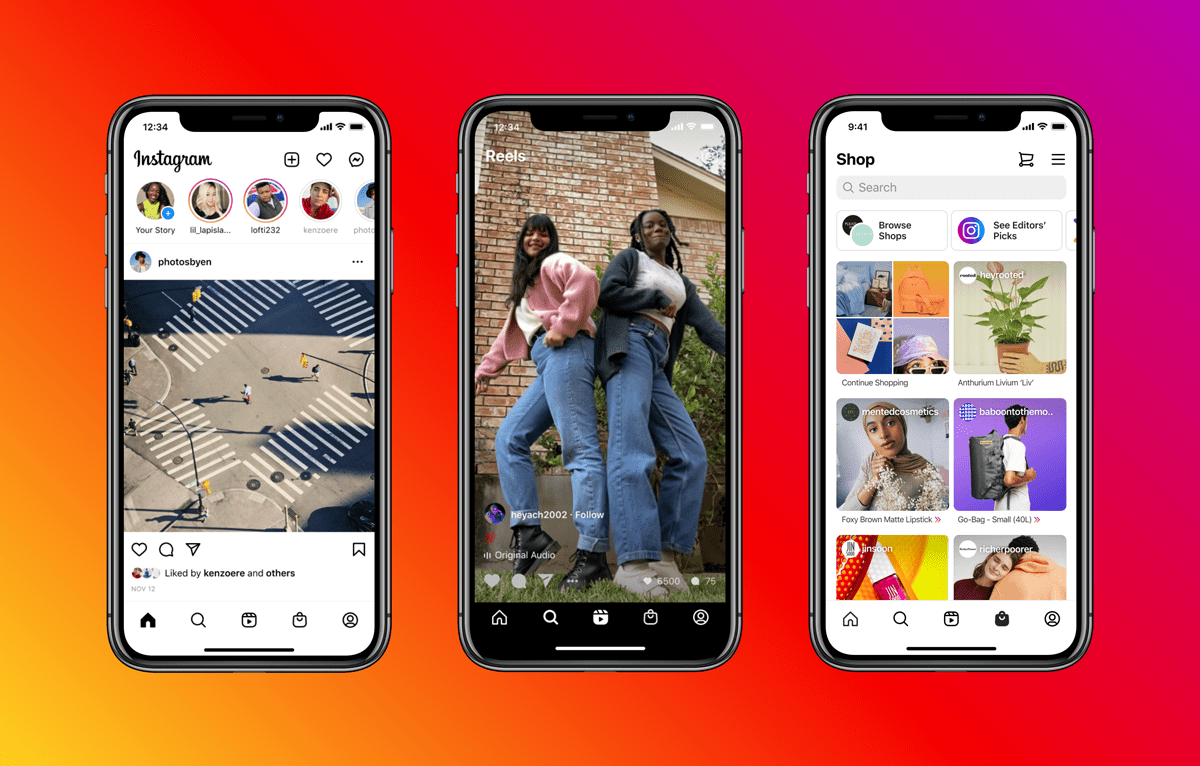

Andjelic asserts that the world is going to see “a lot more” social commerce in 2021: “Not only in terms of Instagram commerce operated by brands, but more importantly platforms like Depop and people buying from people on Instagram — there are a ton of small businesses that sell directly to consumers on Instagram and there are also a lot of resellers that put forward their closets and their personal styles on sale. The resale format is gaining traction as younger people want something more personal, more unique and different than brands offer.”

Livestreaming is another growth area of social commerce that Andjelic predicts for 2021.“Creating shoppable live streamed content gained traction in 2020 and it will become more sophisticated as we go, and more popular in the West,” she says.

Social media commentator Matt Navarra weighs in on the rise of social media “lives” in general: “Lives have become a large part of 2020, pulled into place because of the lockdown situation.” He continues, “In terms of live being a big deal in 2021, I think it’ll be a more significant part, but I think it’ll be done in smaller groups to like-minded people for an influencer, a brand, or a publisher.”

- by Sadie Bargeron

Mentioned in today’s newsletter: Depop, Instagram, Amazon, Shopify, Ocean Spray, Le Creuset, Revlon, Sherwin Williams, TikTok, WeChat, Apple, Google, Douyin, Bytedance, WhatsApp.

One Phenomenon, Two Stories: Will the West Catch Up With China’s Social Commerce?

by Sadie Bargeron

Last month, when Instagram revealed a recent update to emphasize its Shopping and Reel features, it was met with outrage across Western social media, with the leading beauty influencer James Charles stating that the platform was pushing “features that literally no one is asking for.” Despite Instagram being an #ad money-making machine for brands, Western consumers continue to view social media primarily as a creative outlet rather than a commercial one.

Over in China, however, it’s a very different scene, with social commerce sales surpassing $186 billion in 2019 [eMarketer] — ten times the U.S. total, thanks to the deeper integration of content and commerce and its embrace by consumers. In short, there is one phenomenon taking over e-commerce worldwide, just with two very different stories.

Social media commentator Matt Navarra told CCI that, while Charles may be voicing public opposition to Instagram’s latest moves, he also sells out merchandise by marketing on that very platform. “I don’t think [the West] is opposed to shopping on social media platforms, I think that it’s just a relative novelty because there isn’t a fully fledged shopping platform yet,” said Navarra. “I think there’s more of an uproar of people liking other features and not liking change, having to adapt how they use the platform.”

Western social commerce is currently dominated by advertising, rather than transactions. After all, influencer culture is Instagram’s most dominant force, built upon brand marketing. “People love to gather around an individual that represents something they resonate with or support, or find aspirational or inspirational,” said Navarra, noting how influencers carve out online subcultures molded by aesthetics and common values, which brands then emulate.

Social media has also created new expectations of transparency, personality, and relatability in brand storytelling. The past year has seen certain products going viral on TikTok in 2020 without direct brand involvement (or control), proving the power of social content, from Nathan Apodaca skateboarding while drinking Ocean Spray and Sherwin Williams’s paint mixer to the Le Creuset obsession and Revlon’s 2-in-1 hair dryer review videos.

“Brands are seeing their products succeeding better from viral posts than from advertising movements because TikTok trends bring a sense of personability to a product,” said Pippa Speed, associate at London-based marketing agency Truffle Social. “It adds dimensions to what would originally have been promoted directly from the brand.”

Purchases are predominantly influenced by social media, but the West is yet to pick up the pace of China when it comes to integration of mobile payments. For example, last year Tencent’s WeChat saw mini programs generate transactions valued at more than $115 billion. (eMarketer)

Rui Ma, co-host of Pandaily’s Tech Buzz China podcast, told CCI that WeChat owes its success to influencer culture as well as its simple-to-share structure. “You are either led to the product by your friends, or you purchase directly from a person, i.e. influencer,” said Ma. “The former was helped by the fact that WeChat was such a great product for sharing — especially through unique features such as mini programs — and the latter was just much more normal in China, with endorsements always being a big deal and commission-based shopping guides a common fixture in many Chinese stores.”

Influencer marketing is the common thread in these two social commerce stories, yet the structures of the most popular apps differ. Instagram is algorithm-driven, whereas China’s leading social commerce app WeChat is not. “[Instagram] is trying to keep people on the platform as long as possible, that is definitely a motivation,” said Navarra. “The difference is in Western countries, apps don’t have the same integration into their daily lives with one specific app to do lots of things.”

WeChat founder Allen Zhang crafted his do-everything app with pure functionality in mind, which is why there are no ads on the open screen and messages do not show read receipts. WeChat thus offers a more relaxing social shopping journey, giving users access to mini program stores, rather than forcing products upon them in the time-sucking, ad-bombarding Instagram mode.

Perhaps WhatsApp’s shift toward in-app e-commerce is the sign that U.S. tech is finally digesting China’s social commerce story. The Facebook-owned messaging service recently introduced catalogs and shopping carts, allowing users to browse and add products from different retailers. However, if WhatsApp were to reach a comparable level as WeChat (which currently hosts some 2.3 million mini programs) Google and Apple would stand to lose out exponentially — the former currently has 2.87 million apps on its store, and Apple has 1.96 million. (LD Investments)

Livestreaming is another element that factors into China’s social commerce success while yet to take off in the West. Even pioneers such as Bytedance, which launched e-commerce on Douyin in 2018, has only just started to roll out shopping features on its global counterpart TikTok.

The coming year is sure to reveal whether the West is following China’s social commerce strategies, or whether it is simply choosing to continue on a different journey.

TikTok Take

TikTok is being sued for misuse of data from underage users: A 12-year-old unnamed girl from London is suing the Bytedance-owned platform on behalf of all minors under 16 using the app, due to misuse of personal information and breaches of U.K. and E.U. data protection laws. Despite the terms of service stating that users must be over 13, many of the app’s most prominent stars joined at a younger age, according to Sky News.

Star-studded virtual NYE party: Celebrating the talent that makes TikTok tick, the Bytedance-owned platform hosted a New Year’s party on December 31 on the official TikTok account, presenting live appearances and performances from Lil Yachty, Brittany Broski, Jason Derulo, Saweetie, Aly & AJ, Tai Verdes, Cardi B, Fleetwood, Liam Payne, Charli and Dixie D’Amelio, and more.

How 2020 saw TikTok change fashion: Vogue reflects on TikTok’s seismic influence on the fashion industry throughout the year. The platform took on fashion week, with high-end labels partnering with the platform’s biggest creators, from Dixie D’Amelio and Chanel to Addison Rae and Miu Miu, models were scouted on TikTok, designers shared their creative processes, trends were launched, and brands were born.

Feature shows users their “Year on TikTok”: From Spotify Wrapped to Instagram’s Top 9 Year In Review, social apps provide users with end-of-year recaps in December, and TikTok is the latest to jump on the bandwagon. The new “Year on TikTok” feature is a video highlight reel showing people their top TikTok moments, including when they first downloaded the app and their favourite video genres, music, and creative effects.

Trump administration appeals court order blocking TikTok ban: CNN reports that on December 28, the U.S. Department of Justice filed an appeal of a judge’s order that blocked restrictions on TikTok. A pending sale of TikTok’s U.S. operations to Oracle and Walmart has not yet been finalized.

Google pilots short-video carousel feature: The search engine is testing a new feature showing Instagram and TikTok videos in their own dedicated carousel within the mobile Google app, TechCrunch reports. Previously, the “Short Videos” carousel had been focused on other platforms: Google’s Tangi, Indian competitor Trell, and YouTube.

Bytedance seeks to apply its AI powers to health care: TikTok’s parent company has begun searching for professionals in AI drug development across Mountain View, Shanghai, and Beijing. TechCrunch reports on the job posting: “We are looking for candidates to join our team and conduct cutting-edge research in drug discovery and manufacturing powered by AI algorithms.”

Global News

From Amazon’s supremacy in the age of Covid to Walmart’s plans for TikTok, a roughly chronological list of the 101 biggest business moves of the pandemic. Marker

And a look ahead at retail trends for 2021 from Bain & Co. partner Marc-Andre Kamel, with Gen Z and China shaking things up. Harvard Business Review

KFC launched a gaming console with a built-in “chicken chamber” to keep players’ meals warm. Business Insider

The hotly anticipated Gucci x North Face collaboration looks set to add another element of fun by working with Pokemon Go in some as yet to-be-revealed capacity. Hypebeast

Pierre Cardin’s fashion licensing legacy, and the lessons to be learned from it. The Fashion Law