The Nike and LV Masterclass in Crisis Communication

Plus: Cloud shopaholics, cultural livestreamers, and Report Corner.

Part one of our series on lessons from China’s coronavirus experience discussed the importance of brands having an early focus on being helpful to consumers, but communication efforts are also key. Whether announcing donations, offering new services to help consumers cope, or simply expressing empathy and concern, making connections matters right now.

In China as overseas, branding experts are pretty unanimous in this advice: One of the worst things a brand can do during a time like this is to wait silently on the sidelines. Instead, finding ways to problem-solve with consumers and leveraging the variety of digital platforms available to make meaningful connections will help maintain relevance and support loyalty in these trying times.

Even when a brand has little to say in the face of the great uncertainties ahead, a heartfelt message can go a long way. A good example is Louis Vuitton’s brief WeChat post, shortly after parent LVMH had announced major donations to support relief efforts in Wuhan. The message read: “Every paused journey will eventually restart. Louis Vuitton hopes you and your loved ones stay safe and healthy,” which also made a subtle reference to the brand’s origins as a fine luggage maker.

As Valentine’s Day approached, Louis Vuitton’s stores in China were closed, but the brand launched a pop-up shop on WeChat, with store associates available to assist shoppers via live chat. The resulting online sales were double those of Valentine’s Day 2019.

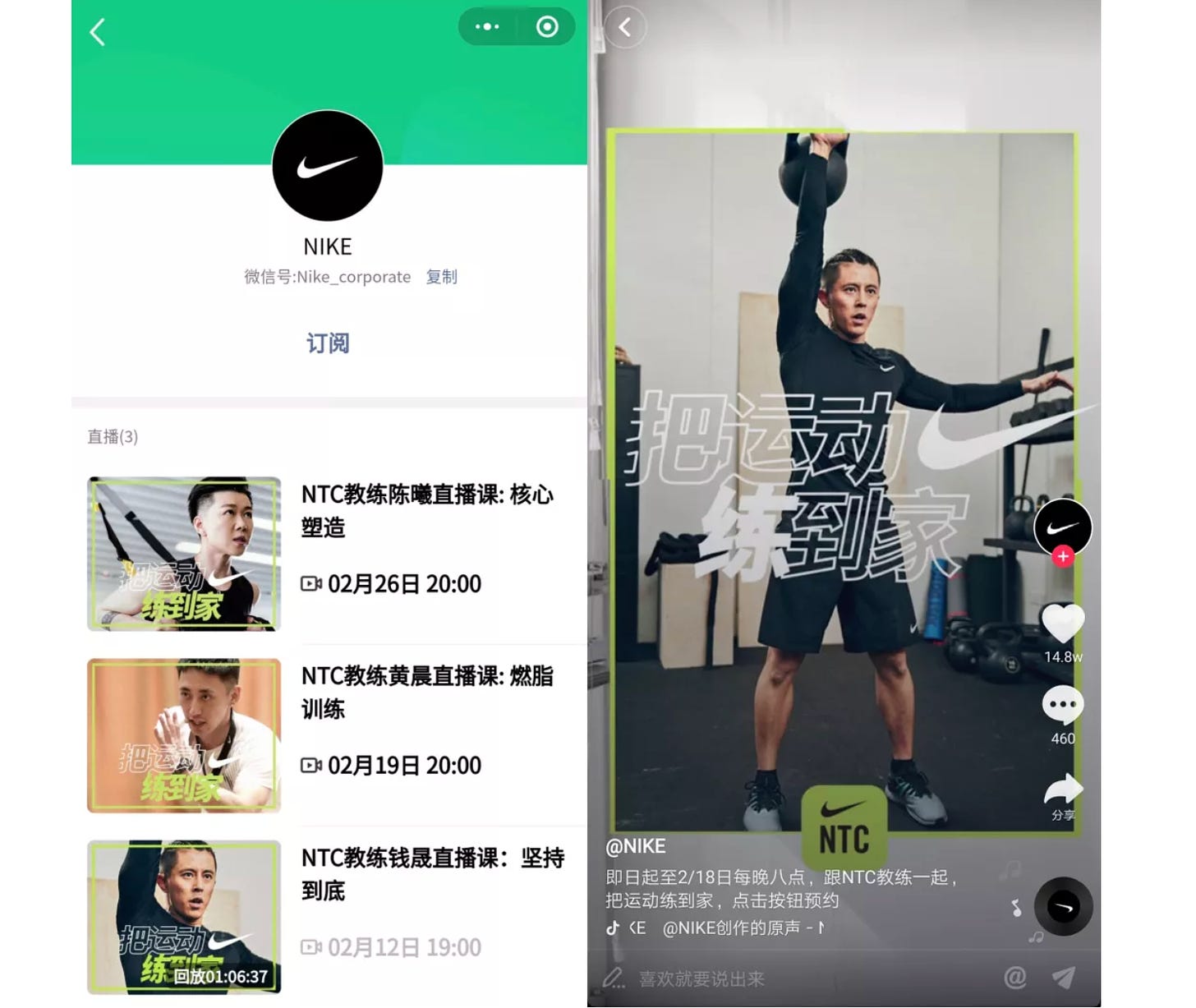

Nike is another company that has effectively communicated its understanding of consumer needs, first in China and now in the U.S. market. During China’s coronavirus lockdown, the sports brand was quick to launch a special series of videos and livestream broadcasts with local coaches and trainers sharing at-home workout tips and exercise plans. That content was widely distributed: In addition to appearing on Nike’s app, it was shared via Douyin, Tencent livestreaming and a WeChat mini-program.

Around 80% of Nike’s stores have reopened in China, and the company reports that online sales largely offset the impact of store closures in the country. “We are seeing the other side of the crisis in China,” Nike CEO John Donahoe said on an earnings call this week. “We now have a playbook we can use elsewhere.”

Nike temporarily closed all U.S. stores on March 16, and is following up to expand the reach of its digital presence in the market by dropping subscription fees on its suite of Nike Premium apps. A corresponding social media campaign has been launched with the slogan “Play inside, play for the world” to encourage being socially responsible while staying healthy with indoor workouts.

The coronavirus crisis is an opportunity to increase goodwill for the long term by building community through an understanding of key consumer needs, even if it means setting aside the usual focus on sales for the time being.

Now more than ever, brands are counting on pent-up demand from China to help offset mounting losses in the West, and those brands that maintained positive connections with consumers during the weeks of confinement at homes — such as Louis Vuitton and Nike — stand to benefit most.

Companies mentioned in today’s newsletter: Alexander Wang, Burberry, Calvin Klein, Discovery, Douyin, Dove, Ikea, L’Oréal, Louis Vuitton, Make Up For Ever, Netease Music, Nike, Oppein, Prada, Suofeiya, Taobao, Tempo, Tencent, Tmall, WeChat, Xiaomi

Trending on Tmall: Luxury Days, Cloud Parties and Home Decor

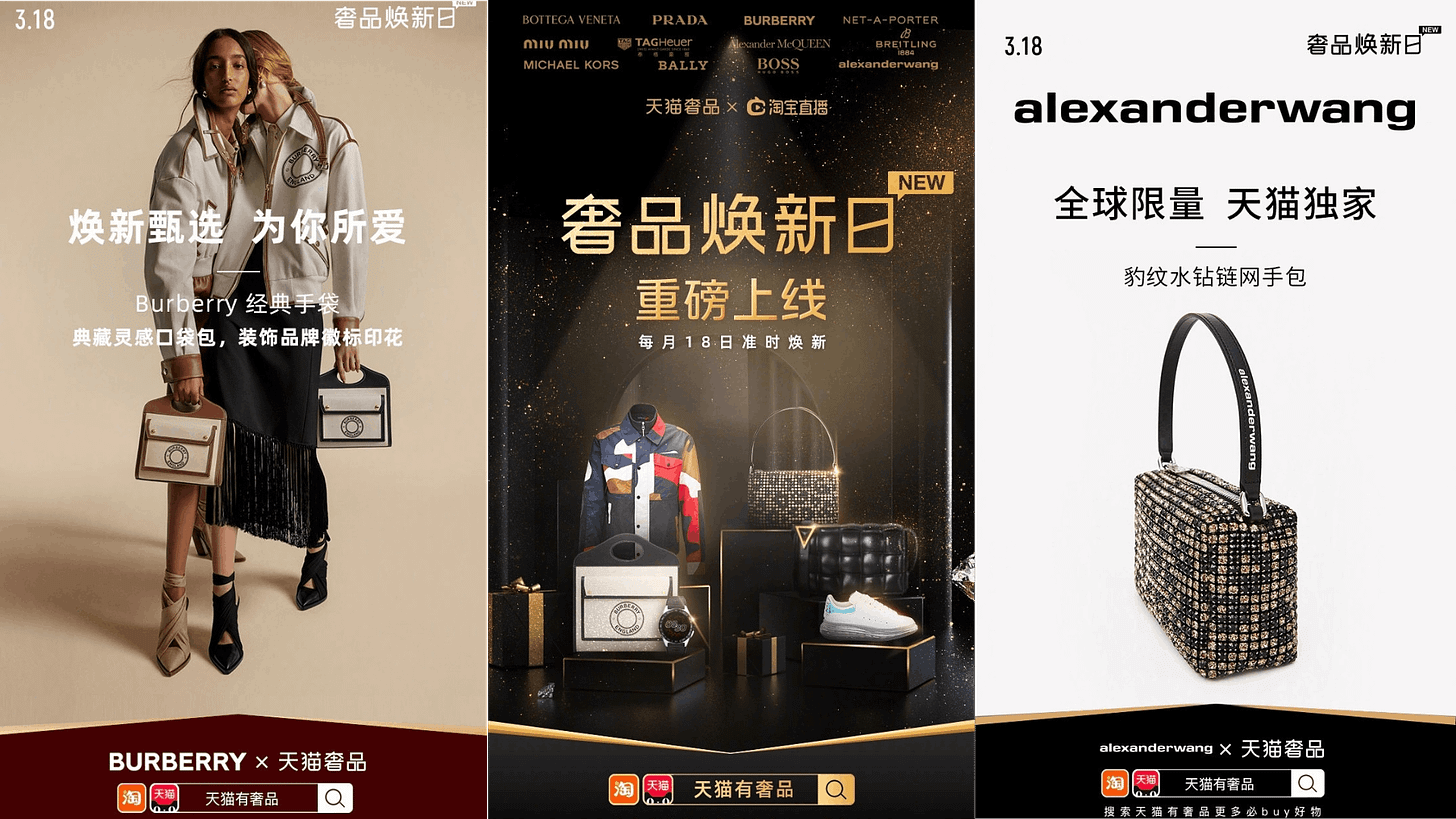

On March 18, Tmall inaugurated a new monthly promotional activity for luxury brands. Co-produced by Tmall Luxury Pavillion and Taobao Live, the first “New Luxury Day” counted Burberry, Alexander Wang and Prada among the participating brands, with a select group of influencers engaged in a 10-hour livestream that took viewers on a “cloud” shopping trip through designer stores.

The e-commerce platform’s experience marketing unit, Tmall Club, hosted an online flash mob on March 17 to promote brand partners including Make Up For Ever, L’Oréal and Calvin Klein through their virtual pop-up stores with celebrity tours of the spaces, livestreamed beauty tutorials and interactive features such as “AI fitting rooms.”

Tmall’s Youth Lab joined with Netease Music to host a “Bedroom Music Festival” to celebrate cherry blossom season with brand partners from the consumer sector including Dove chocolate and Tempo tissue. Ten musicians streamed a concert on March 22 via Netease Cloud Music accompanied by scenes from the cherry blossom season.

A celebrity-oriented campaign aims to introduce the new Ikea Tmall flagship store to the “post-1990” generation. Singer Jike Junyi and actor Li Chen hosted a livestream discussion on interior design, and introduced eight spaces created by Tmall with Ikea and complementary brands such as appliance maker Oppein and custom furniture producer Suofeiya.

How to Grow Your Audience in a Crisis: Lessons From China’s Cultural Institutions

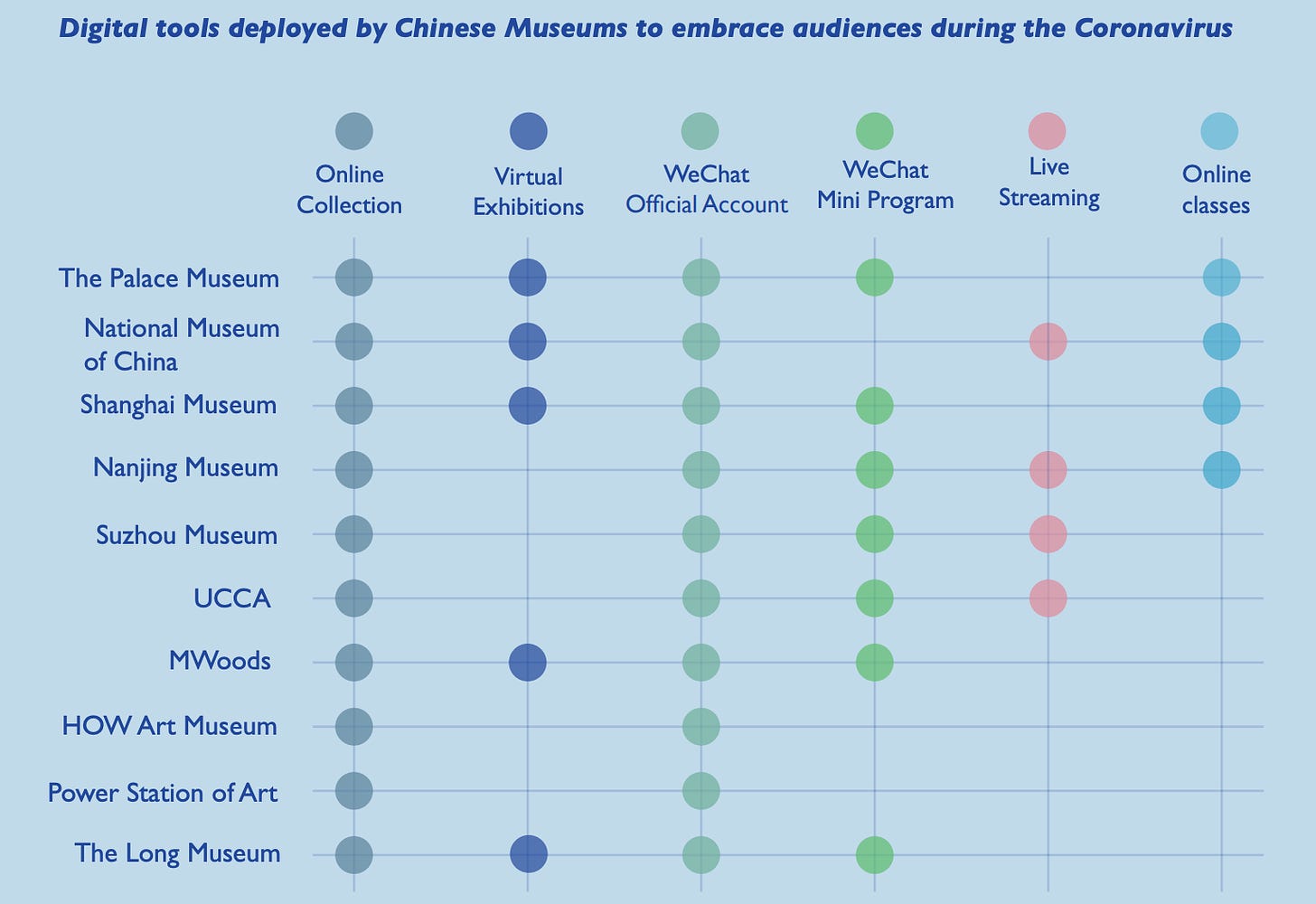

A new in-depth report from our partner site Jing Travel shares key strategies for digital outreach used by Chinese cultural institutions that were forced to close their doors to the public in the wake of the coronavirus epidemic.

More than 1,300 museums shared 2,000-plus exhibitions online between January 24 and February 8, and these have been viewed more than 5 billion times. Some 13 million viewers tuned in to the livestreams from eight museums hosted on Taobao Live, with 40% of the audience in the 26-35 age group.

Online collections and WeChat accounts were among the most common routes to reach audiences, supplemented by offerings such as livestreams, WeChat mini programs and online classes.

Rapid mobilization was seen in the organization of online art auctions for charity, leveraging social media and livestreaming platforms to support meaningful action and align cultural institutions with public welfare.

Museums used the short-video platform Douyin to engage audiences through challenges and a series of livestreamed “cloud tours” of major museums using 360-degree video software to provide immersive viewing experiences.

Download the full report from Jing Travel, a CCI partner site

Brand Film Pick: Xiaomi’s Mi 10 Pro Camera Is the Star of New Films

Last month, Xiaomi released its Mi 10 flagship 5G smartphone with a major livestreamed launch event, and since then the mobile phone maker has been promoting the Pro model’s shooting capabilities with brand films that highlight the quality of its 108-megapixel camera while offering sights and inspiration to consumers who may still be housebound.

Xiaomi partnered with Discovery to produce “100 Million Pixels Capture the Wonder” (一亿像素探索秘境之旅), released on March 12. It follows photographer William Zhang on a 10-day, 1200-mile journey from Yunnan to Tibet, as he trades in his usual pack full of cameras and lenses for the Mi 10 Pro. The film relies on Zhang’s narration to describe the features of the phone’s camera and its ability to withstand the extremes of altitude and cold weather encountered on the trip.

By working with Zhang and Discovery, an established brand in the travel documentary space, Xiaomi is able to portray its device as a professional-level piece of equipment, and the film’s story gives viewers hope that one day they too will be able to follow in Zhang’s footsteps.

A week later, Xiaomi released a shorter video with a twist. The first minute of “The World on One Square Meter” (一平米上的世界) presents dramatic landscape footage shot with the Mi 10Pro to a soundtrack of electronic music. But in the final forty seconds or so, the audience sees behind-the-scenes footage of the “scenery” — handmade models built of sand, clay and other materials on a tabletop.

The film was produced by Beijing-based Somewhile (三不五时) during the coronavirus lockdown, and it offers a poignant commentary on the spirit of creativity necessary to prevail during such trying times.

Report Corner

A survey of young consumers by China Luxury Advisors in early March found that slightly more than half of respondents planned to be more conservative in their spending this year, with health and wellness emerging as key areas of interest.

Although key economic indicators suffered in the month of February, signs of recovery have some analysts forecasting 15% GDP growth in China in the second quarter as a result of pent-up demand, according to this Reuter Communications report that shares the data underpinning such optimism.

In a recent Nielsen survey, 92% of respondents expressed confidence in China’s victory over the coronavirus, but the new “homebody economy” it created offers new opportunities for brands.

The latest GroupM report on marketing during the Covid-19 outbreak includes case studies of how brands adapted during this period, and notes that mobile advertising increased by 17% year-on-year in February.

Many Chinese internet firms saw significant double-digit increases in revenue in 2019, according to data from 22 companies compiled by Morketing, with Alibaba up by 26% and Tencent seeing a 17.7% percent bump.

News in English

What will China’s “new normal” with the easing of coronavirus-related restrictions look like for brands? Expect greater support from e-commerce platforms such as Tmall and JD.com. The Drum

“It is hard to understate how deeply Douyin has become embedded in Chinese internet culture.” A deep dive into the rise of TikTok parent Bytedance, which has become the world’s most valuable startup, estimated to be worth $75 billion. Nikkei Asian Review

A look into the down-to-earth influencers on “Kuaishou and the platform’s “commercial logic” of rural aspiration, fandom and livestreaming e-commerce. Sixth Tone

Auto brand Mini brought its “Nomad Hotel” fleet of camping cars into the cloud for a 24-hour livestream from the mountains of Yunnan Province that was broadcast via Tmall and Bilibili. Campaign Brief Asia

China’s auto sector, among the hardest hit by the Covid-19 outbreak, is showing clear signs of recovery, though “normal” business may still be months away. The Detroit Bureau

Tencent has launched VooV, an international version of its Tencent Meeting videoconferencing app. Overall, it has fewer features than Zoom, but it does include beautifying filters to make attendees look more polished. Abacus

We’ve Got China Covered

China Film Insider: Bytedance Gaming Play Doesn’t Threaten Tencent — Yet

Jing Daily: Can “Revenge Spending” Save Luxury in China?

Jing Travel: Mister Rogers Vibes and Chinese Folk Stars: TikTok and Douyin Success Stories

Thank you for reading! We hope you and your families stay safe and healthy in the current social distancing climate, and would love to hear from you if you have any feedback, comments, or just want to say hi: Contact CCI.