Swarovski’s Brand Refresh: China-Facing or China-Inspired?

Plus: A brand collaboration dream team, Bilibili meets Beckham, and Pinduoduo (briefly) outdoes Taobao.

Published three times per week, the Content Commerce Insider newsletter highlights how brands create content to drive revenue, globally. If you have received our newsletter from a friend or colleague, we hope you will subscribe as well and follow us on LinkedIn and Instagram.

Recently, Austrian crystal giant Swarovski teased its total brand makeover via short video, offering a sneak peek at its first major overhaul in more than three decades. Spearheaded by Agency General Idea (which has previously worked with Loro Piana, Moncler, and Louis Vuitton), the brand refresh reflects the influence of Giovanna Engelbert, who was appointed as Swavorski’s first-ever creative director last year. General Idea founder Ian Schatzberg told Marketing Brew that the new look was “born out of Giovanna as a designer, her vision, and her world. It’s a creative director-led brand now, and we worked in partnership with her.”

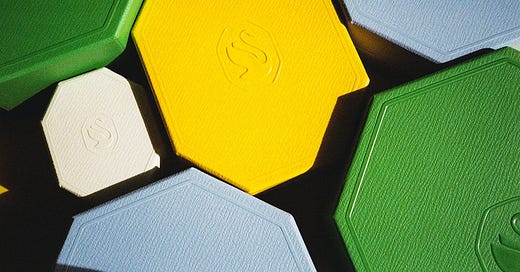

The “Wonderlab” short film stars model Adwoa Aboah, Gwendoline Christie (of “Game of Thrones” fame), and Isla Johnson from Netflix’s recent hit, “The Queen’s Gambit” (playing chess with crystal pieces, naturally). The broader rebrand, set to be fully unveiled on March 19, revolves around a colorful revamp of the traditional Swarovski packaging and a new swan logo.

Based on the brand collateral that has been released so far, it looks like Swarovski’s new look is China-facing, if not China-inspired. Last year the Chinese market offered a rare bright spot for luxury and premium fashion, and 2021 is expected to remain challenging for the industry as a whole, meaning that the competition to stand out among China’s increasingly important millennial and Gen Z consumers will take on even more urgency.

Last year, in an effort to appeal to younger demographics, Swarovski tapped the hugely popular Gen Z idol Wang Yibo as brand ambassador. Wang served as the face of Swarovski’s Women’s Day campaign, and shared a video message to promote a line of limited-edition crystal-studded jewelry that included the letters Y, I, B, and O that was quickly snapped up by his fans. In November, Wang helped the brand launch a collection of limited-edition pieces for the November 11 Singles’ Day sales and appeared in a series of short films to introduce the collection, which proved to be one of the most popular limited edition sets of the season, with fans sharing screenshots of their order confirmations to show their support for the idol.

The colorful nature of Swarovski’s refresh will appeal to young shoppers in mainland China. As we have seen from domestic brands beloved by China’s Gen Z — among them Perfect Diary and Hey Tea — strong splashes of color and playful designs, when paired with affordable price-points and the right celebrity or influencer partnerships, are a winning combination. And now, what works among younger millennial and Gen Z consumers in China is also proving to work globally, such as Douyin/TikTok (even though TikTok, for now, has fewer features than its Chinese counterpart).

Now, one question is who Swarovski plans to work with in China to promote its new look — whether it will stick with the tried-and-tested Wang Yibo or enlist new faces, or whether the global Wonderlab campaign will be enough of a draw for young Chinese consumers, who are also huge fans of “Game of Thrones” and “The Queen’s Gambit” (the latter was the highest-rated English-language TV series of 2020 on the Chinese review site Douban). Another question is whether the brand makeover will be enough to help the family-owned Swarovski better compete against Tiffany & Co., which was recently acquired by LVMH and has already spent more than a decade expanding in China to corner the affordable jewelry market.

It also remains to be seen how the full unveiling of the brand refresh goes over in China. What has been teased out so far hasn’t been completely without criticism, with some netizens expressing a preference for the old logo, which was more recognizable and implicitly high-end, while others commented that the changes makes Swarovski look less like a premium jewelry brand and more like a “two-yuan shop on the side of the road.” Can’t please everybody.

- by Avery Booker

Mentioned in today’s newsletter: Apple, Bytedance, Converse, Douban, Douyin, EA Sports, Feiyue, Fendi, Hey Tea, LVMH, Li Ning, Louis Vuitton, Mercedes-Benz, Netflix, Nike, Peacebird, Perfect Diary, Pinduoduo, Pokémon, Sony, Swarovski, Tiffany & Co., TikTok, Weibo, Wrangler.

Brand Collab Pick: Peacebird Men x Rick and Morty x Joshua Vides

For brands with the means, three-way partnerships are becoming increasingly popular in China, as they offer a way to heighten the creative intensity and stand out from the crowd of one-on-one collaborations.

Hot on the heels of its latest “SuperChina” release with six independent domestic brands for its womenswear line, Peacebird’s mens’ brand will open a pop-up exhibit at Fiu Gallery in Shanghai to showcase a collaboration with American artist Joshua Vides, who reimagines the adult animation “Rick and Morty” through the lens of his signature black-and-white aesthetic. Peacebird has been teasing the product drops through a series of animated videos on Weibo, depicting the gallery space as a two-dimensional “freak lab” where surprises will be hidden in every corner.

All of the parties involved have been deeply engaged in the brand collaboration space: Peacebird’s recent partnerships include Pokémon and old-school Chinese sneaker brand Feiyue, Vides has worked with the likes of Fendi, Converse, Mercedes-Benz, and Nike, while Rick and Morty have become favorites of Madison Avenue, promoting products such as Wrangler jeans and Sony’s Playstation 5.

Even Fiu Gallery has a strong commercial bent, described as more of a concept space that stays “close to the lifestyle of young people” by making art accessible and affordable through merchandise.

News From China

Beckham’s shout-out to Bilibili creator: The creators (also known as “Uploaders”) from the favored platform of China’s Gen Z have started to draw attention from global heavyweights.

Last month, Apple CEO Tim Cook made headlines for granting a video interview to a 22-year-old Bilibili creator, and now soccer legend David Beckham has taken to Instagram to praise another Uploader who had recreated some of his most famous goals on FIFA 21, the latest version of EA Sports’ simulation game.

From a soccer stadium in Florida, Beckham narrated his reactions as he watched a video by the creator known as YMJ playing on a big screen: “It’s incredible,” he said. “Every little detail. It’s literally like watching the same thing twice….YMJ, I am very impressed. I think what you’ve created is incredible because it is so life-like. Even to the point where, you know, the play just before the goal. I mean, it’s perfection.”

After Beckham’s video was posted, YMJ shared his own response in a Bilibili video, which he titled, “The dream I fantasized about 10 years ago has finally come true! Beckham shouted out to me!” That video also went viral, drawing more than a million views within 48 hours.

In November 2020, EA Sports announced that the retired Beckham would return to the sport as a character in its FIFA game. YMJ, who started sharing videos of himself playing soccer simulation games in 2018, has more recently been focused on recreating some of the sport’s most famous goals, which brought him to the attention of EA Sports. The resulting cross-platform dialogue between Beckham and YMJ offers a strong example of how Bilibili can help brands convey messages through authentic user-generated content.

This just happened, briefly: For two days during the Spring Festival, social e-commerce platform Pinduoduo's daily active users (DAU) surpassed the number of longtime market leader Taobao’s mobile app for the first time ever.

According to data from QuestMobile, in January Taobao’s mobile average DAUs were 319 million, while Pinduoduo’s figure was 274 million. However, on February 12, Pinduoduo drew some 259 million users, compared to 237 million for the Taobao app. Pinduoduo also saw its daily average usage time increase by some 25.9% during this year’s holiday period compared to 2020.

This turnaround was achieved through the tried-and-tested Chinese customer acquisition strategy of cash giveaways, which is especially popular during the Spring Festival. While Pinduoduo was forced to withdraw from its prominent sponsorship of the CCTV Spring Festival gala show due to workplace scandals including the deaths of two employees, the company made a point of giving away even more cash than its rivals, in what was already a record-breaking year in the annual “hongbao wars.”

Pinduoduo spent some RMB 3 billion ($460 million) on its red envelope giveaway, and launched a "No Closing Spring Festival" campaign to ensure 48-hour delivery for purchases from participating merchants.

“Queen’s Day” commerce: While originally a socialist holiday, International Women’s Day has been transformed in China into yet another significant shopping festival, with an increasing number of platforms engaging in weeks-long promotions around the March 8 date, which goes by “Queen’s Day” or “Goddess Day” in the country.

With big aspirations in e-commerce, Douyin has launched a ten-day Queen’s Day shopping festival filled with celebrity livestreams, deals and discounts, and other related activities and promotions from brands such as Apple, Perfect Diary, and Li Ning.

The event is part of several big moves by the video platform to become a viable e-commerce player — these include mobile payments, a foray into group-buying, greater emphasis on consumer protection, and the relocation of its e-commerce business unit from Beijing, where parent Bytedance is headquartered, to Shanghai, China’s fashion and retail capital.

News in English

The ongoing tech crackdown: China’s market regulation fined five platforms involved in community group-buying for disruptive business practices and false or misleading pricing — all are owned or backed by major firms: Alibaba, Tencent, Meituan, Pinduoduo, and Didi Chuxing. Reuters

China’s internet giants will remain in the spotlight during the upcoming “two sessions” political spectacle, the first gathering of political leaders and members of the tech elite since authorities began to scrutinize the so-called “platform economy” for monopolistic behavior. SCMP

With investments in Chinese and overseas startups worth an estimated $259 billion, Tencent plays a role akin to a top-tier venture capital fund. Wall Street Journal

With Clubhouse now banned in China, smartphone maker Xiaomi has opted to bring back its defunct messaging app MiTalk as an invite-only audio chat platform for professionals. SCMP

How Pinduouo is driving a farm-to-table movement in China through real-time matching of supply and demand. Pandaily

Japanese resale platform Mercari will start selling in China through two of Alibaba’s channels: its general e-commerce platform Taobao and Xianyu, which is focused on secondhand goods. Nikkei Asia

Idol Lu Han stealthily founded streetwear label Un Garcon Charmant three years ago, but only recently revealed his role as he wanted to let the brand “grow organically.” i-D

Actress Song Yi issued an apology for promoting an upcoming drama series in outfits representing a cutesy “marriageable style” designed to appeal to men. Drama Panda

The number of mobile phone subscribers in China reached 1.59 billion in 2020, more than the total population of 1.4 billion. China Internet Watch

China’s spending on R&D hit a record $378 billion in 2020, or roughly 2.4% of GDP. By comparison, the United States was expected to spend just $134 billion last year. CNBC

It’s complicated: Chloe Zhao’s big win for “Nomadland” at the Golden Globes has been celebrated in China while also drawing scrutiny. Variety

We’ve Got China Covered

China Film Insider: China’s TikTok Is Banning Users Who Brag About Their Wealth

Jing Daily: When China’s Luxury Market Sputters, Brands Must Diversify

Jing Culture & Commerce: Why Museums Need to Build Communities, Not Followings on Social Media