January 2021 Social-Savvy Brands: Gucci x Doraemon

Plus: Loewe taps China's heritage trend, Alibaba out of the doghouse, and will brands take the podcast plunge?

Published three times per week, the Content Commerce Insider newsletter highlights how brands create content to drive revenue, globally. If you have received our newsletter from a friend or colleague, we hope you will subscribe as well and follow us on LinkedIn and Instagram.

Social Commerce – selling through social media – is becoming the norm in China. Simply advertising through Tmall is not enough to attract young Chinese consumers.

Every month, Dao Insights select the brand that has used Chinese social media in an exemplary way to gain attention.

Month: January 2021

Brand: Gucci

Campaign: Gucci x Doraemon

Social Platforms: WeChat, Weibo, Xiaohongshu, Douyin

About the Campaign

The Lunar New Year is one of the most important occasions for brands to make a lasting impression on their Chinese audience, and Gucci didn’t disappoint. The brand’s limited-edition collection is based on the popular Japanese animated character Doraemon, which most post-90s Chinese consumers grew up watching on TV. In fact, the blue robot cat is a nostalgic icon among millennials and one of the most influential Japanese cartoons in China.

Seeing as 2021 marks the Year of the Ox, Doraemon was given a special makeover for Gucci’s campaign, receiving two horns and a golden dye job for his fur. The crowd went wild.

How the Campaign Topped Chinese Social Media:

Customised red envelopes on WeChat

Red envelopes (or hongbao) filled with money are a key part of celebrations for Lunar New Year. WeChat opened up a whole new world of possibilities for brands to leverage Chinese traditions and interact with consumers when it introduced digital red envelopes in 2014.

For this particular Lunar New Year campaign, Gucci created a red envelope customized with the original blue and ox versions of Doraemon. It was launched on the brand’s WeChat mini-program on January 12. The exclusive red envelopes were in high demand – 5,653 participants voted that they had grabbed a red envelope in a survey on Weibo, while 45,814 users had been left empty-handed. In a massive win for Gucci, a completely organic hashtag, “#Gucci’sWeChatRedEnvelope”, which was posted by a netizen, rather than the brand itself, gained 160 million views on Weibo. While the collection did gain considerable organic views, Gucci also embarked on paid advertising.

Paid advertising on Douyin and Xiaohongshu

Gucci purchased advertising space on both Douyin’s (aka Chinese TikTok) feed and Xiaoshongshu’s (aka Little Red Book) loading screen to promote the collection. The seamless integration of Douyin’s advertising into its feed means that brands are better able to attract users’ attention, making it more effective than on other channels.

Seamlessly integrated online pop-up stores

Gucci x Doraemon launched seven pop-up stores across tier-one and tier-two cities, namely Beijing, Wuxi, Xiamen, Shenyang, Shanghai, Wuhan, Nanjing and Chengdu. The integration of these physical stores and online activities proved to be an effective engagement driver, as checking in and sharing live locations, known as daka (打卡), is extremely popular among China’s youth. Many visitors checked in and shared their experiences and photos of the pop-up stores on Xiaohongshu, Weibo, and Douyin.

Celebrity and KOL endorsements

Consumers weren’t the only ones to publicly display their support for the campaign — Gucci also received endorsements from Key Opinion Leaders (KOLs) and celebrities. One KOL praised the creative co-branding on her Xiaohongshu account and wrote that the inclusion of Doraemon reminded her of her childhood. As it turned out, this feeling was widely shared and her post gained 751 favorites and 477 bookmarks.

Famous singers Li Yuchun and Lu Han, and actresses Song Yanfei and Song Zuer all shared Gucci’s pop-up stores and new collection on social media to their huge follower bases. This helped the luxury brand appeal to a wider audience, with Lu Han’s post featuring Gucci’s new products and its official website gaining more than 642,000 reposts and 405,000 likes.

Social commerce

The deciding factor that made Gucci January’s top social-savvy brand is that every aspect of the campaign had seamless e-commerce integration.

The hashtag #DoraemonxGucci page on Xiaohongshu directly linked to Gucci’s official website, where users could purchase the collection. Gucci also offered its official website on their Weibo post, while on Douyin, users could either get access to Gucci’s website through Gucci’s VIP room or via the in-feed advertising.

While all of the above linked to the brand’s official website, on WeChat users can buy the collection directly through Gucci’s WeChat mini-program.

The power of nostalgia marketing

Gucci’s campaign showed the power of nostalgia marketing, a strategy that has been popular among brands in the run-up to the Lunar New Year in 2021, demonstrating that they clearly did their research on which character would resonate with China’s young luxury consumers.

The appeal of the campaign was most notably reflected in the engagement on social media: the hashtag related to the Gucci x Doraemon collection hit more than 3.5 million views on Douyin, 1.3 million views on Xiaohongshu and 100,000 views on the WeChat post.

Mentioned in today’s newsletter: Agora, Alibaba, Alipay, Burberry, Clubhouse, Douyin, Gucci, iQiyi, JD.com, Juhuasuan, Kuaishou, Lizhi, Loewe, Pepsi, Pinduoduo, Pop Mart, Tencent Video, WeChat, Weibo, Xiaohongshu, Youku.

Will Global Brands Take the Podcast Plunge in China?

For major global brands working to strike the right balance in their China marketing mix, one of the biggest and more consistent challenges is deciding which online platforms to adopt and which to ignore. Over the past decade, brands flocked first to Weibo and then to WeChat to reach (and ultimately sell to) consumers in mainland China. More recently, brands have turned to launching official accounts on platforms such as Douyin, Xiaohongshu, and Bilibili, allowing them to leverage the popularity of e-commerce livestreaming and short video among millennial and Gen Z consumers.

So far, one global trend that has yet to fully gain traction in China among major brands is podcasting. The Chinese model of audio has some characteristics that set it apart from the West’s, which is largely ad-supported but shifting towards being more listener-supported. In China, free podcasts tend to be entertainment-based, while paid, subscription-based podcasts — part of China’s booming “knowledge” economy — are attracting a flood of revenue and investment.

According to Marketplace, this knowledge economy (or, more accurately, the “pay-for-knowledge” economy) was already worth an estimated $7.3 billion in 2017 and has continued to expand since then, thanks to skyrocketing demand for content on topics such as personal finance, self-help, and health and wellness. The growth has been brought about by “a combination of factors: [the] desire for focused information that’s useful and relevant; the need to update skills constantly in China’s competitive job market; the ease of paying on a mobile phone; and FOMO — the fear of missing out.”

As is the case in other paid content sectors in China — such as streaming video, which can offer subscribers early access to their favorite programs, retail partner discounts, and other perks — the pay-for-knowledge economy unlocks exclusive content for paid podcast subscribers.

To date, major global brands have yet to fully tap into this trend in China as part of their marketing strategy, likely because the sector is not well understood. As NiemanLab has previously noted, comparisons between the United States and China are difficult in no small part because Chinese players are far more expansive: “the proper comparison would be to the U.S. podcast industry grouped together with the wider universe of audiobooks, meditation apps, and, at some future point, Spotify.”

Yet the past week has seen global attention turn to Chinese interest in audio, as a brief frenzy for purchasing Clubhouse invites followed Elon Musk’s surprise appearance on the American platform before access was curtailed. The Clubhouse craze put the spotlight on Chinese firms involved in audio, such as Agora, which provides tech that powers Clubhouse, and Lizhi, China’s second-largest audio platform — with both seeing their U.S.-listed shares spike in recent days.

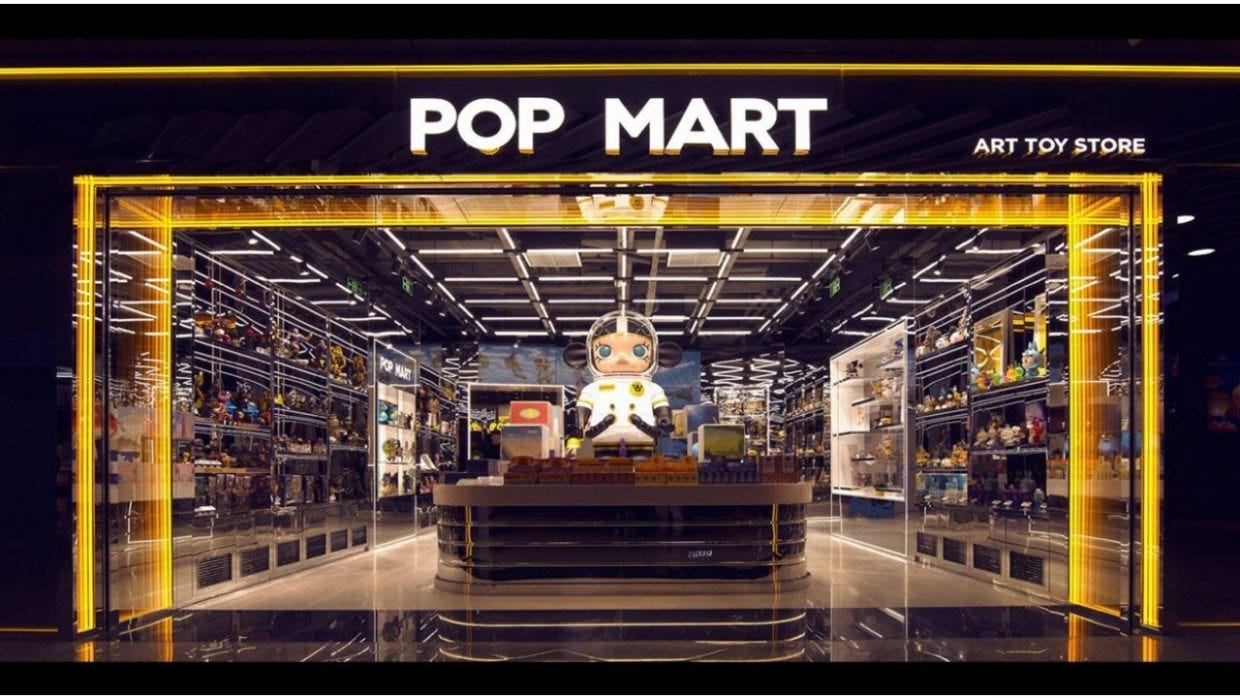

Branded content could be the next frontier for audio in China, as last week the Nasdaq-listed Lizhi, which bills itself as a “UGC audio community and interactive audio entertainment platform,” announced a deal to create a branded podcast channel for Pop Mart, the biggest player in China’s fast-growing blind-box collectible toy market. This will be the first branded channel on Lizhi’s new Podcast mobile app, which the company debuted in January. Given that much of Pop Mart’s business revolves around collaborations with global partners — from museums to beauty brands to food and beverage producers — its upcoming channel could offer a way for global brands to dip their toes into China’s audio scene.

"Branded podcast is a new way of branding and this collaboration is an attempt of Pop Mart to use a different medium to increase its brand awareness among its audience.” said Lizhi CEO Marco Lai, added that the company is looking to collaborate with more brands in the future to help them “reach new audiences, increase brand awareness, and engage their users with curated podcast content."

New of Lizhi’s deal with Pop Mart, coupled with the Clubhouse connection, sent its shares soaring by more than 400% last week. And although no other branded podcast collaborations have been announced yet, investors appear intrigued by Lai’s plans to build the app into a global audio entertainment powerhouse. Now, the question is whether we will see other brands — particularly bigger-ticket names that center their marketing around content that is educational and oriented towards brand history and heritage — decide on a similar approach in China.

Brand Film Pick: Loewe Taps China’s Heritage Trend for Lunar New Year

by Avery Booker

With the Lunar New Year just around the corner, brands have been busy releasing special collections for the Year of the Ox, holiday-themed video games, and, of course, brand films centered around the Spring Festival, typically emphasizing family and togetherness (a tougher-than-usual note to hit, considering that domestic travel will be curtailed for another year due to clusters of Covid-19 outbreaks).

Following other recent buzzed-about productions such as Alipay’s “Expectation” (望), JD.com’s spot by director Lu Chuan, Burberry’s “A New Awakening” (心春由你), and Pepsi’s annual “Bringing Happiness Home” campaign, Madrid-based luxury brand Loewe recently took a novel approach with its series of three short films celebrating the diversity of Chinese folk arts associated with the holiday.

Highlighting the traditional crafts of Feng Xiang woodblock prints from Shaanxi Province in the north, Yuting cakes from Guangdong in the south, and Daoming woven bamboo from Sichuan in the southwest, the series offers a glimpse into the lives of families dedicated to preserving these ancient skills and techniques for future generations (echoing, in a way, the mission of Shanghai-based luxury brand Shang Xia).

The piece on Feng Xiang woodblock-printing looks at the 500-year-old art form, profiling master craftsman Tai Liping, a twentieth-generation heir to the tradition, and his daughter-in-law Wang Yixuan, who prepares to follow in his footsteps. Next, Loewe takes us to Huizhou in southern China to visit Su Shun’an, whose mother passed down the craft of making Yuting cakes, a traditional pastry made from black sesame rice flour using intricately shaped molds — Su refers to as “nostalgia on a plate.”

Finally, the series introduces us to Daoming bamboo weaver Yang Longmei, who learned the 2,000-year-old skill from her father, as she takes viewers through the creation of traditional lanterns for the Lunar New Year. (View the entire series on CCI.)

This film series comes at exactly the right time, riding the guochao (国潮, “national trend”) wave that shows no sign of slowing down, allowing housebound audiences to experience new places, and meeting consumers’ needs for brands and products that resonate on a deeper level. Loewe has steadily built a connection with consumers in China via targeted efforts like its Paula’s Ibiza livestreamed concert last summer, featuring performers from the popular competition show “Rap of China” (中国新说唱), collaborations with domestic brands like The Beast, and releases such as the Loewe x Totoro collection, which tapped into the magnetism of anime and nostalgia among Chinese millennials and Gen Z.

Each video in its Lunar New Year series closes with the line, “Supporting Craft Since 1846,” establishing a parallel between the brand’s history and rich traditions of the families profiled. Without ever showing a single Loewe product (only the occasional logo), the brand ties these stories to Loewe’s stated focus on craftsmanship and heritage, succeeding in striking the right emotional tone that sets successful brand films apart from glorified advertisements.

News From China

Is Alibaba back out of the doghouse? There are signs that the e-commerce giant is getting back into Beijing’s good graces.

First, its financial affiliate Ant Group — the first Alibaba entity to come under scrutiny when its November plans for a $37 billion mega-IPO were scrapped by regulators — has reportedly reached a deal on restructuring that will see it turned into a holding company, and it also plans to spin-off its consumer data operations, paving the way for another go at listing next year.

Chinese media report that Alibaba will once again muscle in on the sponsorship action of state broadcaster CCTV’s Spring Festival Gala show, which will air on the evening of February 11. Last year, even as Kuaishou grabbed headlines for its RMB 1 billion ($150 million) giveaway as the exclusive interactive partner for the world’s most-watched TV program, Alibaba found a way to get valuable airtime with a deal for Juhuasuan, its flash-sales platform, to act as CCTV’s exclusive e-commerce partner during the show. This year, Douyin has stepped in to replace the scandal-ridden Pinduoduo as CCTV’s top sponsor, with plans to give away RMB 1.2 billion ($160 million) to viewers in virtual red envelopes (hongbao) during the gala, but Alibaba’s Taobao could top that by giving away RMB 2 billion ($300 million) as this year’s e-commerce sponsor, according to reports.

CCTV is also featuring Viya, Taobao’s top livestreamer, Viya, on its pre-show for the big gala, “New Year’s Eve GO Youth” (春晚GO青春). Viya will serve as the “exclusive quality product recommendation officer” for the event, promoting Spring Festival products (年货) and agricultural goods from rural areas that could use an e-commerce boost, and sharing pre-recorded segments with some of the celebrities appearing on the main show. Last week. Li Jiaqi, the number-two seller on Taobao Live, was featured on another CCTV Spring Festival show focused on the internet and youth.

Kuaishou’s Hong Kong IPO made global headlines on Friday as the company’s shares tripled on their debut, and a big question is how it will use the $5.4 billion it raised to tackle challenges such as slowing user growth, major losses due to marketing and R&D expenses, and diversification of revenue. The platform has been investing heavily in original content and support for creators.

In true content-commerce fashion, Kuaishou highlighted its emphasis on entertainment with a Spring Festival-themed show produced in partnership with CCTV News that aired on February 4, the eve of its Hong Kong stock market debut. The celebration brought together ten groups that combined traditional celebrities such as CCTV anchors and popular idols with grassroots creators and amateur performers who have come up through the short video platform, a strategy that was also used for Kauishou’s big TV extravaganza “1,001 Nights” (一千零一夜) back in October.

Two days later, Kuaishou took its content innovation in another direction with a “cross-dimensional” Spring Festival concert that brought together established real-life stars such as the folk singer Tengger with virtual idols like AC Niang, the representative of the Kuaishou-owned anime platform ACFun, performing alongside each other. Playing on one of the hottest virtual idol trends, singer Huang Zitao introduced the debut of his digital avatar “Selu,” the latest effort to expand Kuaishou’s audience towards the mainstream of Gen Z.

The little watermelon game that could: A simple fruit-based mobile game, Synthetic Watermelon (合成大西瓜), has taken China by storm, with nearly 100 million players engaging with the official version.

The addictive game, which has been compared to a mix of Tetris and 2048, is almost as easy to code as to play, which has given rise to a slew of variations replacing the fruit of the original with kittens or celebrities such as BTS’s V.

The Chinese snack maker Want Want has gotten in on the craze with its own branded version of the game featuring a variety of its most popular products, and using the brand’s name as the sound for merging pieces. It’s a savvy way to get keep the brand in consumers’ minds during the Lunar New Year holiday, a period when people typically buy snacks such as Want Want’s to share with guests.

News in English

China’s market regulator officially formalized a set of anti-monopoly guidelines that were released in draft form last November, aimed at “stopping “monopolistic behaviours in the platform economy.” Reuters

E-commerce platform Vipshop was slapped with a $464,000 fine for unfair competition, one of the biggest penalties under Beijing’s latest crackdown on powerful players in the internet economy. Reuters

China had 989 million netizens as of December 2020, and is likely to have more than 1 billion sometime this year, according to the latest national internet report. Sixth Tone

Rival video streaming platforms iQiyi, Youku, and Tencent Video announced a joint online cinema project to promote their premium-on-demand movies during the Spring Festival holiday. Pandaily

From Apple to Oreo, a look at 18 strong campaigns from international brands for the Lunar New Year. Daxue Consulting

More successful holiday campaigns, these ones from Chinese brands. Dao Insights

How to win at Chinese shopping festivals? With lots of advance planning and a focus on establishing long-term connections with consumers, according to a WPP report. Alizila

Pastoral influencer Li Ziqi has set a Guinness World Record for the “most subscribers for a Chinese-language channel on YouTube,” with more than 14 million followers on the platform. Inkstone News

Alibaba’s cross-border e-commerce platform Tmall Global saw year-on-year growth in the number of brands and merchants increase by more than 60% in 2020. China Internet Watch

U.S. brands are betting big on social commerce, with their optimism fueled by China’s example as the most advanced social commerce market in the world. eMarketer

The China Association of Performing Arts published a new “self-discipline” guideline for celebrities that could have a disproportionate impact on women performers. Sixth Tone

We’ve Got China Covered

China Film Insider: The Small-Time Reality TV Hit Reviving Chinese Theater’s Big Dreams

Jing Daily: “Femvertising” Is Luxury’s Key to Winning Young China

Jing Culture & Commerce: A “Connected Digital Experience”: How Microsoft Hopes to Transform Museums