Future Tech China: How Taobao Makes Money

Plus: Comedians as influencers, Burberry's esports play, and Neiwai celebrates diversity.

The Content Commerce Insider newsletter highlights how brands create content to drive revenue. If you have received our newsletter from a friend or colleague, we hope you will subscribe as well and follow us on LinkedIn and Instagram.

It's that time of the year again, for the twelfth year in a row: the Singles’ Day “season.” Soon, Alibaba will announce they have "yet again" set records for sales and gross merchandise volume (GMV) — and so history repeats itself. What’s different this year is that consumer recovery is key and Alibaba’s platforms (Tmall and Taobao among them) offered an additional three-day key sales period from November 1 to 3, along with an expansion of deals and discounts into non-traditional e-commerce categories such as apartments and automobiles.

Now that we have the shiny new things out of the way, let's get to how it all really works. And more importantly, why.

Comparing the Taobao, Tmall, and Amazon Business Models

The secret is in the business model. Amazon's shopping website makes some dependable and consistent revenue through its Prime membership service, which adds up to around $7 billion a year. However, the company monetizes primarily through transaction fees, charging anywhere from 8% to 15% for each item sold through a third-party merchant.

Alibaba is a behemoth, but let's compare apples with apples and focus on its most popular e-commerce platforms: Taobao and Tmall. Founded in 2003, Taobao is business-to-consumer (B2C) and charges no transaction fees to either sellers or buyers. Yes, that's correct: no transaction fees. So it's not necessarily in Alibaba's interest to sell more. Fee-free Taobao makes money by charging sellers for SEO-like advertising. Taobao's business model is more similar to Google’s than it is to Amazon’s.

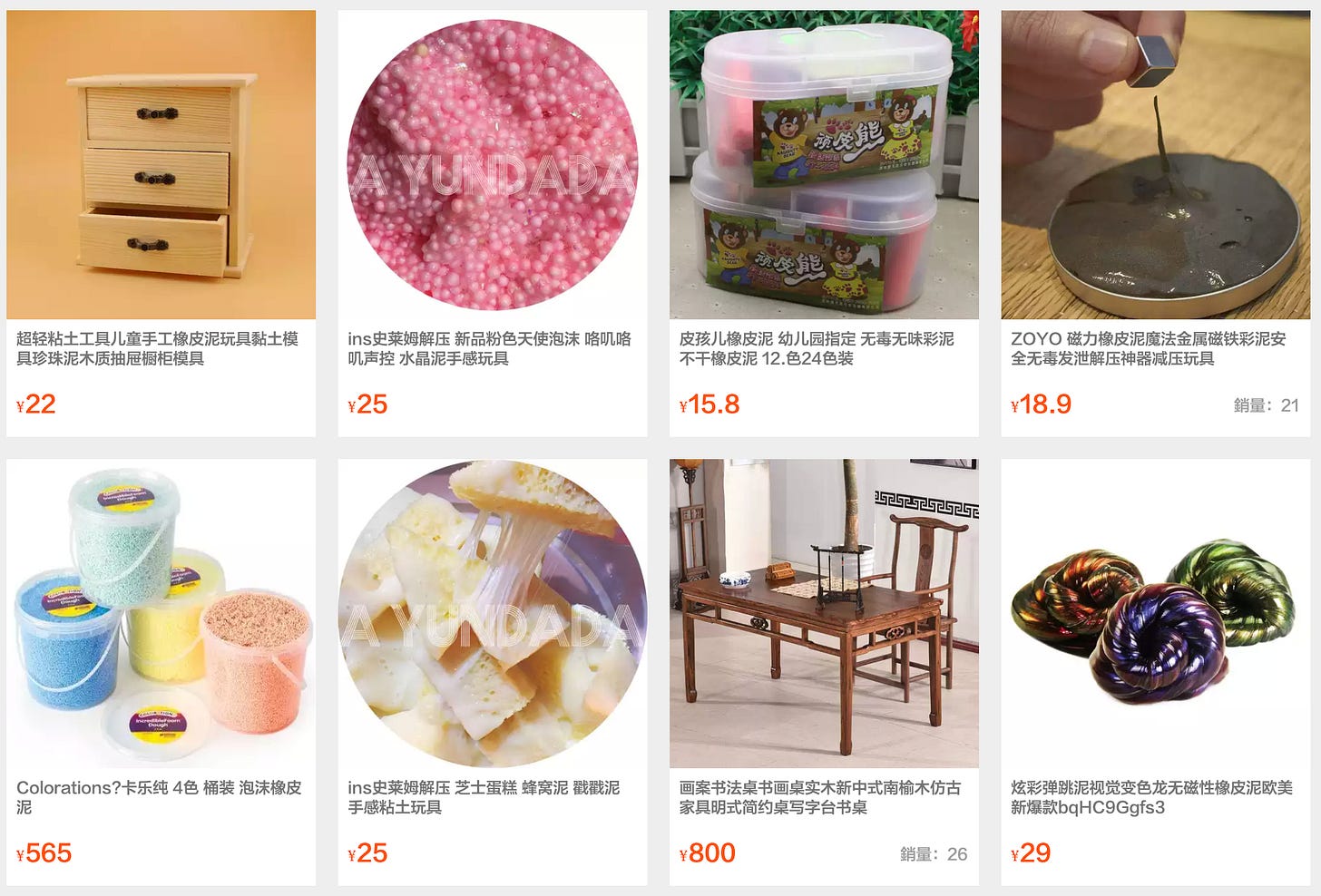

As a result, Taobao's objective is to gather as many merchants on the platform as possible so that they can compete with each other for the attention of buyers, and so that Taobao can charge advertising — that’s how it all comes together. As of 2019, Taobao had eight million active storefronts and more than one billion product listings. These are the gladiators and Taobao is the arena, charging for the necessary tech (weaponry) upgrades to survive.

Then we have Tmall, which was spun off from Taobao in 2008. Whereas Taobao is full of smaller merchants and no-name products, Tmall connects premium brands with consumers. This is where you find all the high-end labels (via the Tmall Luxury Pavilion) and a more upscale online shopping environment, with brand-controlled official flagship stores. Alibaba is pushing the platform hard, sharing success stats faster than you can whisper “cash cow.” That's because Tmall charges brands an annual $5,000 in, here it comes, transaction fees ranging from 0.5% to 5%. On top of all that, Tmall also requires a one-time security deposit of $25,000.

Tmall is for bigger brands. It is very successful and, unlike Amazon, Alibaba does not appear to be interested in stealing business from brands à la Amazon Basics (the private label that has been accused of copying brand-name products to siphon sales from its own third-party vendors).

Evolving With China’s Consumer Upgrade

Whereas Taobao's GMV has been stagnating, just about doubling from RMB 1.6 trillion ($240 billion) to RMB 3.4 trillion ($510 billion) between 2015 and 2020, Tmall more than quadrupled in the period, from RMB 847 billion ($127 billion) to RMB 3.2 trillion ($480 million).

A lot of that has to do with the Chinese consumer lifestyle upgrade, which had only just started back in 2003. At that time, it didn't make sense to charge consumers who were new to e-commerce and more importantly, new to shopping, an additional fee. Alibaba didn't go public until 2014, eleven years after the birth of Taobao. I'd be curious to see how long it took for a fee-free platform to become profitable. Surely, nobody was paying for advertising in the beginning.

But that’s also a key reason why Taobao is so chock full of content. Unlike Google, its business model sibling, Taobao had to incentivize competition, and it did that by encouraging vendors to join its platform and creating more touchpoints for advertising in various forms.

To its credit, when Taobao e-commerce started becoming increasingly mainstream in China, it still didn't implement transaction fees, and spun off Tmall instead. Taobao is like the Chinese consumer of fifteen years ago, with a dislike of fees and prioritizing the ability to choose from a sea of products for the best value. Its generic products and minimal branding are features, not bugs.

Tmall is the more sophisticated Chinese consumer of the present day, seeking out quality products that are strongly branded, even if that means fewer choices and higher prices. Tmall’s consumers, unlike Taobao’s, don't want many options and the sheer volume of competition, but they spend more, so Alibaba opts for transaction fees.

To sum up, Taobao wants to be hyper-competitive. Tmall wants to support sales. Amazon just wants to see the world burn...I mean, sell things online.

Resources:

- by Tanya Van Gastel

Mentioned in today’s newsletter: Alibaba, Burberry, Dior, MAC Cosmetics, Procter & Gamble, SK-II, Neiwai, L'Oréal, Biotherm, Xiaohongshu, Louis Vuitton, Netease, Yili.

Comedians Score Laughs and Sales as China’s Newest Brand Darlings

While most brands rely on the star power of actors and idols whose passionate fans are willing to make purchases in order to support their favorite celebrities, new opportunities are arising with more down-to-earth comedians to represent brands with humor.

The success of the recently concluded third season of Tencent Video’s stand-up competition “Rock & Roast” (脱口秀大会) has brought its top contestants numerous new fans, along with the attention of brands and e-commerce players that have been quick to seize on their potential to help boost sales during the hotly contested run-up to Singles’ Day on November 11. JD.com recently partnered with the producers of “Rock & Roast” to livestream a “season 3.5” of of the series that promoted the advantages and benefits of shopping via the platform during the Singles’ Day sales period, while Alibaba’s Taobao Live has assembled a cast of a dozen comedians to share daily deals on hot products during this time.

Although she didn’t win, Li Xueqin was arguably the breakout star of the latest edition of “Rock & Roast,” a rare female comedian in a predominantly male field. Following her appearances on the show, she has signed deals with major brands such as Yili dairy and was invited to appear on other shows and to engage in e-commerce livestreaming for platforms such as Taobao Live and Xiaohongshu.

“Rock & Roast” champion Wang Mian, meanwhile, has also been actively working with brands during the run-up to Singles’ Day, appearing in e-commerce livestreams to promote L'Oréal and Biotherm, among others.

Stand-up comedy is still a relatively new format in China, and comedians lack anything akin to the established bar and club scene of the United States and other Western countries. Instead, they make their names through open mic events and through televised competitions such as “Rock & Roast,” but their earning power from live events remains limited (even in China’s post-Covid era), and they are more reliant on using digital media such as livestreaming for income. This creates numerous opportunities for brands to partner with comedians on various platforms (including Douyin and Kuaishou) to entertain audiences while introducing products and encouraging purchases.

Click here for more comedy cases (link in Chinese)

Alibaba Hosts 11.11 Live Program For Brands Looking to Tap China

Presented by Alibaba

Every year, Alibaba’s 11.11 Global Shopping Festival (also known as “Singles’ Day”) sets the tone for the state of consumer spending in China. This year, the story isn’t about the sales figures we’ve come to associate with 11.11, but about opportunities for global businesses – big and small.

While not a consumer-facing event in the U.S. and Europe, thousands of U.S. and European brands participate in the event for the unmatched opportunity to grow their businesses globally. It’s akin to the Super Bowl for more than 250,000 brands, where they pull out all the stops to wow Chinese consumers, and where Alibaba unveils the latest in retail innovation.

In 2020, Alibaba is working to support brands’ expansion efforts in the market. “Understanding 11.11: Alibaba’s Mega Shopping Festival” is a live virtual event tailored for Western audiences to learn about the opportunities of the Chinese consumer market and how to succeed there.

Tune in on November 11 at 10:30 AM EST / 4:30 PM CET.

CCI Take: Luxury Brands Chase the Esports Opportunity in China

by Avery Booker

In addition to a millions-strong community of gamers and tech companies both domestic and international, a handful of luxury brands are entering China’s booming esports sector. It’s perhaps no surprise why, owing to the rise of esports in the market — the number of gamers reached 540 million in the first half of 2020, and the industry generated $10.3 billion in revenues — and the fact that China remains virtually the only bright spot for luxury in 2020.

Louis Vuitton has been in the lead with its trophy cases for League of Legends championship events, and also created capsule collections and virtual skins for players of the hugely popular game, while other brands such as Dior have tapped the ACG (Anime, Comic and Games) community. Now, the digitally savvy Burberry is the latest to join in the fray through its newly announced partnership with Tencent Games on its multiplayer online game Honor of Kings.

According to Burberry, the partnership looks to leverage the increasing importance of interactive digital content in inspiring luxury consumers, noting that “games offer another opportunity for consumers to connect with Burberry’s products online.” While specific details were not released, the company added that the collaboration will center on virtual products, calling it part of “Burberry’s digital agenda.”

Read the full article on Content Commerce Insider

Why Luxury Certificates Will Soon Be Standard in China

Key Takeaways from Jing Daily’s piece on the importance of luxury authentication in China:

A joint report by China’s University of International Business & Economics and Isheyipai estimates that sales of second-hand luxury products in China now accounts for 5% of the personal luxury goods market.

JD.com’s anti-counterfeit system Hubaochui can notify brands when fake versions of their products are being sold by third-party merchants.

Entrupy asserts that it has an archive of millions of images and can authenticate the 15 top luxury brands.

Read the full story on Jing Daily

Brand Film Pick: Neiwai Looks at Intimacy From the Inside Out

Chinese lingerie brand Neiwai (literally, “inside-outside”) has taken a very public role in promoting self-acceptance among women, a strategy that meshes well with its emphasis on streamlined, minimalist designs, natural fibers, and comfort (no fussy lace bits here), making a splash among consumers with its body-positive Women’s Day campaign and film in March and the recent appointment of legendary singer Faye Wong as brand ambassador.

For its latest clothing collaboration with fashion brand Xu Zhi, Neiwai has released another buzzed-about brand film, this time exploring various perspectives on intimacy in relationships. The five-minute film, produced by the digital video channel Nowness, features five couples and individuals with diverse sexual identities, which is still a rarity in Chinese media. The feedback was positive from viewers who appreciated the brand’s efforts to reflect reality over outdated social norms.

News From China

SK-II, the Japanese skincare brand owned by Procter & Gamble, is taking an edgier approach in its marketing to appeal to young Chinese consumers.

The brand recently worked with rapper Lexie Liu to promote a limited-edition Singles’ Day collaboration with three street artists on a series of graffiti-inspired designs for its classic Facial Treatment Essence.

The choice of Liu, who rose to fame as a contestant on the second season of “The Rap of China” in 2018, became a trending topic on Chinese social media as she was an unexpected choice for the premium beauty brand, and Liu also appeared on a Tmall livestreamed broadcast to promote the products alongside actress Jin Jing.

The beauty brand also took an international approach to promoting the new products, with a multilingual rendition of Mariah Carey’s “Fantasy” by Chinese singer Dou Jingtong, Japanese actress Ayase Haruka, and American actress Chloë Grace Moretz.

Taking a decided step away from the Singles’ Day marketing mania, Netease announced that its consumer-to-manufacturer e-commerce platform, Yanxuan, will opt out of participating in this year’s event. Singles’ Day, which was originally launched by Alibaba as a one-day sale in 2009, now involves just about every major online retailer and stretches for several weeks leading up to the big November 11 date, with increasingly diverse and complex efforts to keep consumers engaged and spending along the way.

In a statement, Netease said that Singles’ Day now promotes excessive consumption and overemphasizes sales results, and promised to offer greater year-round discounts via Yanxuan, along with guaranteed low prices for certain products.

News in English

Ant Group’s Hong Kong and Shanghai IPO plans were suddenly put on hold amid concerns from Chinese authorities over inadequate regulation of the fintech giant, with an expected delay of six months. Bloomberg

Why a planned listing of Douyin could have negative consequences for other apps in Bytedance’s universe. S&P Market Intelligence

A Chinese tech proxy war could be brewing at the New York-listed Farfetch if Alibaba joins as an investor in the luxury fashion platform, which already counts JD.com and Tencent among its backers. Reuters

China’s latest five-year plan is expected to further boost tech research and development as Beijing seeks greater self-reliance and innovation from the country’s firms. SCMP

Magic Johnson will be promoting hemp- and cannabis-based body products via Taobao Live for Uncle Bud’s, one of many American brands making their first efforts to connect with Chinese consumers during this year’s Singles’ Day. Bloomberg

Chinese e-commerce start-up iDS BuyBuyBuy raised $40 million in new financing as it aims to build a marketplace for both international and domestic beauty brands. WWD

The number of online gamers in China hit around 540 million in the first half of 2020, representing 57.4% of all internet users. China Internet Watch

With international travel still largely off-limits, China’s upper-middle-class consumers are forced to rethink their consumption of global luxury goods. Sixth Tone

The hotpot chain Haidilao has won over Chinese consumers with more than food: Exceptional customer service that reimagines dining as an entertainment experience is a key to its success. Dao Insights

We’ve Got China Covered

China Film Insider: Broadway Is Adapting “Farewell My Concubine,” Chinese Audiences Are Worried

Jing Daily: Tips for This Post-COVID-19 Singles’ Day

Jing Culture & Commerce: Museums and Mobile Gaming: The Next Digital Frontier