Future Tech China: How Can Brands Best Leverage AR in China?

Plus: Our exclusive interview with Everlane, recent brand integrations, and a potato chip epic.

The Content Commerce Insider newsletter highlights how brands create content to drive revenue. If you have received our newsletter from a friend or colleague, we hope you will subscribe as well and follow us on LinkedIn and Instagram.

The global augmented reality (AR) market is projected to surpass $100 billion by 2024, fueled by demand in retail, gaming, and entertainment, with some 72% of customers already reporting that AR influenced them to purchase items they hadn’t planned on buying. These reports came out pre-Covid — so that doesn’t even account for increased demand for "remote retail" from the pandemic.

Some of the technology required for the widespread consumer adoption of AR will take longer to develop, and that is mostly due to hardware constraints (looking at you, VR). But smartphone-enabled AR is increasingly within reach for many.

When brands ask themselves how they can find the sweet spot for AR/VR integration in their retail strategy, they would do well to be mindful of Newton's first law — the path of least resistance.

People don't like to download apps, let alone buy more hardware. What's been the most successful new gadget of the last decade? Most are extensions or magnification of smartphones. Wearables? Wearables are (mostly) phones that are strapped closer to your body. Tablets are bigger phones. Smart voice devices are standalone phones. Et cetera.

Integrating tech into mass-adopted hardware (smartphones) works. It could look like Ikea's Place app, which consumers can use to gauge how much space is required for various furnishings in their homes. It's currently the second-most popular free app built on Apple’s ARKit, and boasts more than a million downloads on the Google Play Store. But that is a rare example of a widely-used AR app. The Gap's app, which has a virtual dressing room, has about 100,000 downloads. Then there's Balmain, whose app flaunts AR content, with just over 100 downloads. Ikea’s Place adds real value by answering questions such as, "Will I actually be able to fit this 68-piece couch puzzle after construction?" It's hard to gauge apparel fit through VR for now.

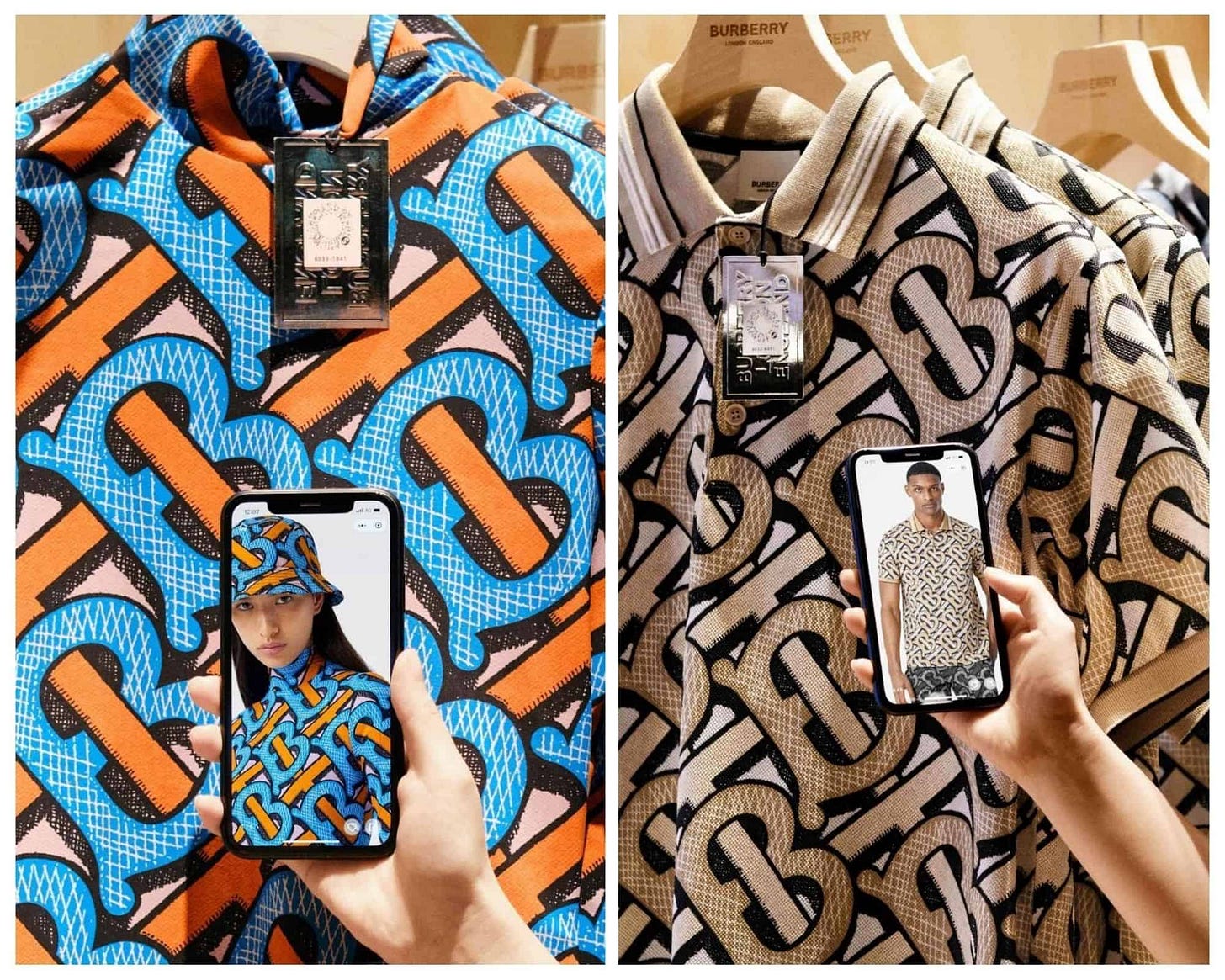

Further down the path of least resistance (and high conversion) is AR integration with mass-adopted apps: Instagram, Snapchat, and TikTok filters. Bonus points for increased social media engagement. Dior made an Instagram filter that lets users try on their newest sunglasses through VR. Consumers can try them on from the comfort of their homes and smartphones. Adidas has also experimented with shoppable AR by launching a Snapchat lens that lets users try on new sneakers.

In 2017, Alibaba and Tencent launched AR games within their apps. Users were able to scan physical objects to find hongbao (red envelopes) with cash inside. Tencent spent over $43 million on its mobile AR game. Later that year, Alibaba’s Ant Financial (Alipay) announced another AR game in its app and set aside $29 million in hongbao to drive Alipay adoption. Driving downloads for apps through financial incentives is a tactic commonly used in China, but much harder to execute to drive hardware adoption.

Virtual reality and mixed reality

VR and Mixed Reality (MR) offer interesting opportunities. Xcommon, a Shanghai-based designer platform, recently collaborated with MR glasses maker Nreal for Shanghai fashion week, showcasing how mixed reality brings pizzazz to fashion. More importantly, the photo-ops that mixed reality offers are great for brands who want to create social buzz.

And some MR headsets are truly astonishing. Microsoft’s Hololens is nothing short of miraculous, but the hardware constraints mean scaling is tough. So no matter how much I'd like VR to take off, it probably won't anytime soon. The hardware is too expensive and the tech too limiting. The gold standard for headset costs around $700, but usually requires you to remain seated and connected to a PC or other rig.

ROI on pricey headsets lies mainly in luring consumers to brand-owned spaces by promising unique digital experiences. The best experiences are those that can be obtained through a smartphone. Because during a pandemic, how many consumers will be able to venture outside to stores for VR- or MR-enabled experiences?

Resources:

Microsoft HoloLens demo (MR), YouTube

Ikea Place app (AR), Google Play Store

Nreal at Shanghai Fashion Week (MR), YouTube

- by Tanya Van Gastel

Mentioned in today’s newsletter: Adidas, Alipay, Apple, Balmain, Bilibili, Burberry, Dior, Douyin, Ele.me, Everlane, Home Facial Pro, Huawei, Instagram, Lay’s, MAC Cosmetics, Mercedes-Benz, Microsoft, Seesaw Coffee, Snap, The Gap, Tencent, TikTok, WeChat, Xigua Video, Yili, Youku.

CCI Interview: Everlane Taps China's Burgeoning Eco-Friendly Consumer

by Avery Booker

For many brands in China, both foreign and domestic, collaborations are becoming a popular way to reach new consumer segments while reflecting brand values in often unexpected ways. To mark the first anniversary of its entry into the Chinese market while highlighting its commitment to sustainability, American direct-to-consumer (DTC) fashion brand Everlane partnered with Alibaba-owned online delivery service Ele.me and Shanghai boutique roaster Seesaw Coffee to produce an environmentally friendly “lunch” set that included a bento box and t-shirt made from recycled materials, along with a package of Seesaw’s sustainably sourced coffee.

Developed by Everlane and the integrated luxury agency Gusto Luxe, the collaboration is a good example of complementary brands coming together to create something that looks and feels more organic than, say, coffee and insect repellant.

This week, CCI connected with Everlane’s International General manager, Agustin Farias, to learn a little more about the brand’s recent campaign and its takeaways from the past year in China.

Read the full interview at Content Commerce Insider

Brands Seek Deeper Integration With China’s Top Reality TV Shows

by Ginger Ooi

It’s no longer enough for sponsors of reality TV shows to simply put their names on sets and on-screen. To stand out from the competition, brands are increasingly seeking new ways to develop collaborative, IP-driven partnerships that can fuse content and commerce.

One of China’s biggest music competition shows “Sing! China” (中国好声音, previously known as “Voice of China”) recently returned for a fifth season on Zhejiang TV with celebrity judges such as Li Ronghao and Li Jian. Title sponsor Yili’s Satine brand of organic milk is deeply integrated into the show through various measures such as on-screen graphics, product displays, and regular footage of contestants drinking the milk.

Yili Satine took its brand integration a step further by creating an online derivative of “Sing! China” called “Good Voice of the Country” (国风好声音) focused on poetry. The brand released an original single “Drink Good Dreams” (饮好梦), featuring a modern beat paired with famous lines from classical poetry, and with a music video that shows singers in traditional clothing.

By tying traditional culture to an appreciation of modern music, Yili Satine aims to encourage a deeper appreciation of cultural heritage, aligning the brand’s values of promoting good health along with a more holistic approach to spiritual well-being.

Youku’s popular culture series “Street Dance of China” (这!就是街舞) aired its season three finale on October 3, reaching more than 20 billion views for the season across various platforms across China and more than 42 billion impressions on Weibo. The influential show has been a magnet for brands who seek to reach its sizeable audience of young, trend-seeking viewers. s

The latest season saw more than 240 derivative products launched with total sales amounting to RMB 250 million ($37 million). Altogether, some 49 brands worked with “Street Dance” this year, including premium names such as MAC, Burberry, and Mercedes-Benz.

One of the most sought-after collaborations came from Chinese skincare brand Home Facial Pro (also known as HFP) and its “Street Dance of China” gift box. Idol Wang Yibo is a spokesperson for the brand and also appeared as a celebrity mentor on the show, which boosted the brand’s exposure, and HFP also offered fans the chance to attend the show via a giveaway.

Brand Film Pick: Director Lu Chuan Chronicles a Potato’s Journey for Lay’s

As consumers become increasingly health-conscious and focused on sustainability, brands best known for producing junk food are under pressure to upgrade their products and brand images.

Lay’s recently tapped renowned director Lu Chuan (“Kekexeli: Mountain Patrol” and “City of Life and Death”) to direct a documentary-style film, “Each Chip Is Just for Your Smile” (每一片只为你的微笑). The nine-minute film traces the “farm-to-bag” process behind the brand’s signature potato chips, highlighting each step from the choice of soil and planting conditions to transportation logistics to factory technology, while celebrating the workers behind the scenes.

With lush cinematography, slow-motion shots, and classical music in the background, the film’s style is reminiscent of popular foodie documentary series such as “Bite of China” and has drawn a large audience, with its hashtag garnering 120 million views on Weibo.

News From China

Apple’s iPhone 12 launch was a top trending topic on Chinese social media while also drawing some mixed reviews, as the U.S. tech brand’s late entry into the 5G handset market was cheered by die-hard fans while others voiced concerns about pricing.

Secondhand trading platform Zhuan Zhuan made a clever play to capitalize on the attention to the iPhone 12 release by staging its own “Old Phone Press Conference” on October 14, announcing tech entrepreneur-turned-e-commerce livestreaming star Luo Yonghao (previously on CCI) as its new brand ambassador. It was a fitting choice, since as founder of phone maker Smartisan, Luo (in)famously boasted of his plans to acquire Apple, while alternately bashing the U.S. tech giant and voicing his ambitions to be the Steve Jobs of China.

Earlier this year Zhuan Zhuan, a subsidiary of classified marketplace 58.com, acquired Zhaoliangji, an app for used mobile phones and accessories, and the press conference highlighted its offerings in this area, with Luo personally recommending models such as the iPhone 11 Pro Max, Xiaomi 10 Pro, and Huawei Mate30. Prior to the event, teasers of Luo with the phrase “I am back” in all caps fueled speculation that Luo would reveal a return to the phone manufacturing business, but it seems he’s doing better for himself as a salesman and promoter for brands, which has allowed him to reportedly repay two-thirds of his RMB 600 million ($69 million) in debt.

Alibaba’s Youku established an unboxing channel ahead of this year’s Singles’ Day to help guide consumers through their purchasing journeys.

With a focus on short video and livestreaming, the channel aims to further enhance Alibaba’s links between content and e-commerce, and features popular categories such as consumer tech, cosmetics, and toys. Singer Wang Feifei, most recently a contestant on the hit “Sisters Who Make Waves” (乘风破浪的姐姐), was appointed as a product recommendation ambassador for the channel, and top e-commerce livestreamers such as Viya are developing content.

The channel will also serve as the official Singles’ Day recommendation platform for beauty products, and 23 international brands will be featured in videos by

Heating up the competition with Bilibili on the content front, Bytedance’s Douyin and Xigua Video have jointly launched a “Knowledge Creator Plan” to develop 100 creators producing high-quality educational content on topics such as science, humanities, and self-improvement.

A month-long open call to creators invites them to participate by posting educational content for evaluation by a committee that includes Wendy Deng Murdoch, magazine publisher and TV host Hong Huang, education entrepreneur Yu Mihong, and science YouTuber Li Yongle.

News in English

WeChat Channels, the short video feature that operates within the Tencent super-app, has started testing out a no-frills livestreaming functionality as part of a broader competitive strategy to challenge Bytedance’s Douyin. KrAsia

A new report on urban millennial and Gen Z consumers highlights eight key trends such as mobile e-commerce and the redefinition of “Made in China.” Euromonitor

A walk-through of how to set up a store on Douyin to leverage the platform’s e-commerce capabilities. WalktheChat

Engagement with consumers has helped shopping festivals such as Singles’ Day transform the retail experience, and the mix of sales promotions and entertainment has potential to become a global phenomenon, says David Roth of WPP and BrandZ. Alizila

Dior has become the first luxury brand to release a capsule collection for Singles’ Day. It was released for sale on October 15, while many more brands across the consumer spectrum are creating limited edition goods for sale during the weeks-long event. WWD

It’s official: Huya and Douyu, China’s leading game livestreaming platforms, will be merged in a move pushed by Tencent, a major investor in both. Reuters

Scammers are impersonating celebrities on Douyin, setting up fake accounts under their names in order to sell goods via livestreaming. Sixth Tone

The market for fake WeChat moments: Users of the app can purchase images of high-end lifestyles to share with their social circles, conveying a false impression of wealth. What’s on Weibo

How Bilibili’s “joint creative process” brings together users and creators to forge deeper connections on the platform. Parklu

An overview of China’s media scene highlights the peak in on-demand video viewing during the coronavirus outbreak earlier this year, with iQiyi leading the sector. GroupM

We’ve Got China Covered

China Film Insider: Profits of Weibo Soar Even as Revenue Falls

Jing Daily: What Chinese Online Platform Is Right for Your Luxury Brand?

Jing Travel: How Chinese Museums Create Identity Through Cultural Products