Future Tech China: Branded Games and Social Are Why Alibaba Fails Where Tencent Thrives

Plus: An entertaining Double-12, how universities can cash in, and cat marketing 101.

The Content Commerce Insider newsletter highlights how brands create content to drive revenue. If you have received our newsletter from a friend or colleague, we hope you will subscribe as well and follow us on LinkedIn and Instagram.

What's been the magical trifecta of Covid-commerce?

Online

Engaging

Social

None of these three things are binary — it's more like a spectrum of engagement, ranging from one-way content like short video to interactive content such as games. Games should be considered less as creative content and more as virtual spaces for branded content.

The games known as MOBAs (Multiplayer Online Battle Arenas), such as China's massively popular Honor of Kings, are pre-populated virtual spaces. Blurring the line between marketing and entertainment, these games excel at content-commerce, and they also happen to be one of the two things Tencent is best at.

Case in point: Honor of Kings is Tencent's prime mobile gaming product, boasting more than 100 million daily active users. Honor of Kings works because playing is a brief and social experience. Gaming sessions are easy for friends to organize over WeChat: after signing in via WeChat, a user’s friends are automatically pulled in, making it easy to find partners for quick 10-minute games that easily fit into busy schedules.

This year, Burberry launched a WeChat game with a trench-coat wearing character called Ratberry (not making this up, it is the “Year of the Rat,” after all). The game was an expansion of a game that Burberry launched in October 2019, and is a prime example of entertainment-first luxury. Users were able to access the game through Burberry's mini program, via a Burberry article, or straight through Burberry’s official account. Since the game lived on WeChat, it was also very easy to share with friends.

Tencent Owns Social

Social is an area that e-commerce giant Alibaba has been agonizing over for a while. And it’s not for lack of trying. Alibaba rolled out Laiwang in 2013 to compete with WeChat on messaging, but the service never took off. And just last year, Alibaba launched Real in another bid to enter the social media space. It's too early to call it a failure, but historically, efforts to challenge Tencent on messaging applications have failed to take hold.

The point here is that messaging is everything — it's how most online users connect with each other. WeChat users (pretty much everyone in China with a mobile phone) spent a third of their online time on WeChat. Tencent knows that, and will do anything to stop its arch-nemesis Alibaba (and vice versa).

This is more than a high-school feud. Links to products on Alibaba's Taobao or Tmall can't be shared easily over WeChat — users have to copy a WeChat-specific link on the product page, send it over WeChat, and then the recipient has to copy this text and open the Taobao app manually. Taobao will automatically detect the text and suggest the product. Not so sleek, but brutally intentional on Tencent’s part.

The clear demarcation between the two ecosystems is also possible because of mobile — it’s no issue to share an Amazon link over Facebook because most of the buying still happens over browsers. For some reason, 58% of smartphone visitors use Amazon.com in the browser, as opposed to using the app. What’s more is that this kind of preferential treatment for Tencent’s own ecosystem will likely be illegal under the soon-to-come European system. That’s likely to extend to US firms, unlikely to Chinese ones who do little e-commerce in Europe or the US.

Bottom line: China’s snazzy e-commerce integration doesn’t count when crossing Tencent and Alibaba platforms.

Tencent supports its own WeChat stores, and the rival e-commerce platforms it has backed financially, JD.com and Pinduoduo. And WeChat is crucial for Pinduoduo. Group (or community) buying, Pinduoduo’s bread and butter, takes place predominantly over WeChat, with the support of the Pinduoduo mini program. Among all the WeChat e-commerce mini programs, Pinduoduo ranks first, and when Pinduoduo launched a new fashion platform this summer, it was as a WeChat mini program and not as a standalone app. The result is mobile, engaging and social — because it’s on WeChat.

Of course, there is no Taobao mini program on WeChat. The thought alone is heresy.

WeChat Mini Games and Mini Programs

Branded games such as Burberry's are generally well-received by Chinese consumers, and that is also largely thanks to Tencent.

WeChat games are mini programs, or lightweight applications, that live within the WeChat ecosystem. They work entirely like apps, but require no downloading and have lightning-fast loading speeds. WeChat introduced the mini programs in 2017, and there are now 746 million monthly active users of mini programs, with some 81% of them also playing mini games.

To use a mini program, users register using a single tap through their WeChat accounts, thereby sharing personal information with the owner of the mini program. WeChat personal information is the Chinese equivalent of an email address, and invaluable for connecting brands to users.

Alibaba rolled out mini programs in 2018, and although they are accessible via Alipay and Taobao, they are nowhere nearly as popular as WeChat’s mini programs. Users mostly access these mini programs to pay vendors, and not to access content like with WeChat mini programs. The average Chinese user is unlikely to be aware that Alibaba uses mini programs for anything other than vendor payments or ordering food at a restaurant by scanning a QR code. Note, however, that anytime Alibaba mini programs are brought up, so is Starbucks’s presence. Yes, Alibaba has a very strong partnership with Starbucks, and that’s been the highlight of Alibaba's mini programs (and pretty much the only one).

WeChat's support for gaming makes sense. Tencent has plenty of expertise through strategic investments and acquisitions involving firms behind some of the most popular titles, such as Riot Games (League of Legends) and Supercell (Clash of Clans). Meanwhile, Alibaba's efforts have lacked the social integration (via messaging and sharing), and gaming expertise that Tencent has so much of.

In terms of gamification, mini programs are where WeChat wins over Alibaba's Tmall or Taobao. Whereas Alibaba appears to prefer launching proprietary games such as Taobao Life or the virtual cat game that was popular during this year’s Singles’ Day, Tencent's mini programs allow brands to integrate their own games into their official WeChat official accounts and disseminate them through social sharing. Alibaba might own e-commerce, but Tencent owns gaming and, more importantly, social.

Resources:

Burberry's Ratberry, Burberry released a series of short videos, showing the trench coat-wearing rodent enjoying adventures around the world — from London’s Chinatown to Turkey — while texting with Burberry brand ambassador and actress Zhou Dongyu.

It's interesting that while the Starbucks mini program is one of Alibaba's biggest, Starbucks still also signed a partnership with Tencent. Ouch.

- by Tanya Van Gastel

Mentioned in today’s newsletter: Absolut Vodka, Adidas, Alibaba, Amazon, Burberry, Dyson, Estée Lauder, Facebook, iQiyi, JD.com, Neiwai, Perfect Diary, Pinduoduo, Pokémon, Porsche, Rimowa, SK-II, Sprite, Starbucks, Tesla, Unilever, WeChat.

After Double 11 Comes Double 12: Content-Commerce Boosts Follow-Up Shopping Festival

by Ginger Ooi

Even though this year’s record-breaking Singles’ Day Shopping Festival just wrapped up in November, China’s major e-commerce platforms wasted no time in gearing up for the next sales event, known as 12.12, or Double 12, over the past weekend, once again relying heavily on entertainment to help drive sales. While the December event could hardly compare to the long-anticipated Singles’ Day, which spanned weeks of frenzied marketing activity, it allowed some participants to experiment with content-commerce campaigns that could draw attention from consumers thanks to a less crowded field.

Alibaba’s Taobao hosted the “12.12 National Taobao Festival” with actor Shen Teng as the lead spokesperson for the event and a marketing campaign that revolved around golden tokens. Taobao produced a 15-minute branded film starring Shen titled “Three Gold Coins” (三个金币) a retro-futuristic feel-good story that encouraged viewers to visit Taobao and make purchases to help them lead happy and fulfilling lives.

Taobao also announced its first “artificial intelligence” virtual idol, Black Tao King, in conjunction with the 12.12 Shopping Festival. Taobao appointed the new virtual star to act as a “Double 12 Shopping Magician” and released a rap song for the event. A corresponding Weibo campaign, the “Magic Tao 12.12 Challenge,” invited users to participate by sharing a “magic product” they wished to purchase from Taobao, with opportunities to win up to RMB 1999 ($306) in prize money to spend on the platform.

Instead of relying on standard livestreaming sales tactics such as having hosts show off its latest models, Tesla created a cross-platform entertainment event for 12.12 in partnership with Alipay. Users could enter via WeChat to play a game that combined consumer education with elements of suspense.

It all started with a trending hashtag, #FindTesla, and a rumor that more than 30 vehicles had gone missing from a Hangzhou showroom overnight. Media outlets jumped on the story, though many on social media wondered how such a large quantity of cars could simply disappear. Videos soon began circulating of supposedly eyewitness footage of the missing cars moving about the city streets, fueling further speculation.

The mystery was solved when Tesla revealed the story as part of the lead-up to the launch of its 12.12 campaign with Alipay. The WeChat game called for players to search for 30 “lucky geese” in order to qualify to win cash prizes of RMB 1000 ($152) and chances to drive Teslas for free for a week.

In contrast to the hyper-competitive atmosphere around Singles’ Day, Pinduoduo was the only e-commerce player to host a televised gala for 12.12. The platform partnered with Hunan Satellite TV for a star-studded prime-time gala on December 11, with RMB 10 billion ($1.5 billion) in consumer subsidies and the lowest prices on sought-after premium products such as SK-II and Estée Lauder skin care, Dyson hair dryers, and iPhones (thousands were given away during the broadcast).

CCI Take: Content-Commerce Could Be a Lifeline for Universities in Need of Foreign Students

by Avery Booker

The past four years have been a challenge for U.S. educational institutions that increasingly depend on revenue from foreign students, with U.S.-China relations under the Trump administration hitting rock bottom and many Chinese students dissuaded from applying at American schools for a myriad of reasons, ranging from concerns about gun violence to the ongoing Covid-19 pandemic.

China leads as the top source of foreign students in the U.S., with nearly 370,000 students at American institutions last year, or more than a third of the total. Chinese students have become a critical source of tuition revenues for U.S. schools, and represent an important group of consumers segment for the businesses in surrounding communities, from car dealerships to malls and luxury boutiques.

Recent actions such as the U.S. State Department’s moves this past summer to revoke the student visas of more than 1,000 Chinese nationals on the grounds that they were “high-risk graduate students and research scholars” only served to inflame tensions, with China’s state-run media publishing editorials that could convince some students that they would only encounter a hostile educational environment in the United States.

However, there is now hope that the incoming Biden administration may heed the calls from university leaders to be more welcoming to foreign students who can bring millions in much-needed revenues. There are also signs that Biden may move to grant green cards to foreign graduates of American doctoral programs under the rationale that “losing these highly trained workers to foreign economies is a disservice to our own economic competitiveness.”

Read the full article on Content Commerce Insider

Brand Collab Pick: Daniel Arsham x Fourtry

For the second season of its hit streetwear-oriented reality show “Fourtry” (潮流合伙人), which premiered on December 4, video streaming platform iQiyi has sought to capitalize on the huge appeal of brand collaborations with a Chinese flair. While the first season was set in Tokyo’s famed style district of Harajuku and emphasized international designers, this year the cool southwest city of Chengdu serves as the setting of “Fourtry,” with a major effort made to appeal to tastes for domestic “national trend” (guochao) products that draw from China’s rich cultural traditions.

IQiyi established three categories of brand collaborations for the “Fourtry” brand in the new season: Fourtry by X (for original designs), Fourtry Crossover (for collaborations with leading players in the youth culture space), and Fourtry Selected, (for partnerships with high-end streetwear brands).

Aiming even higher, iQiyi developed an innovative art and commerce partnership with contemporary American artist Daniel Arsham that further enhances the cultural quotient of the “Fourtry” brand. The artist unveiled an installation, titled "Bronze Fa," at the recent Innersect streetwear convention in Shanghai, which will be housed at the “Fourtry Space” experiential retail store in Chengdu.

In addition, Arsham produced a limited-edition series of five products in collaboration with “Fourtry” for sale in China, including an art piece, mah jong set, keychain, necklace, and rug, all incorporating elements of Chinese art traditions, for a unique merging of heritage and modernity that has drawn interest from Gen Z and millennial cultural consumers.

The collaboration is Arsham’s first with a Chinese content platform, though he has deep experience in working with brands and reimagining their signature products through the lens of architecture and performance, with previous partnerships with international brands such as Rimowa, Adidas, Pokémon, and Porsche.

News From China

As noted in this week’s Future Tech China column, WeChat mini programs are the secret to Tencent’s social success. E-commerce consultancy Azoya has just published its “Playbook for E-commerce 2021,” which is focused specifically on the WeChat mini program format and features numerous case studies involving high-end brands in the fashion, beauty, and lifestyle sectors. Key takeaways for the year ahead:

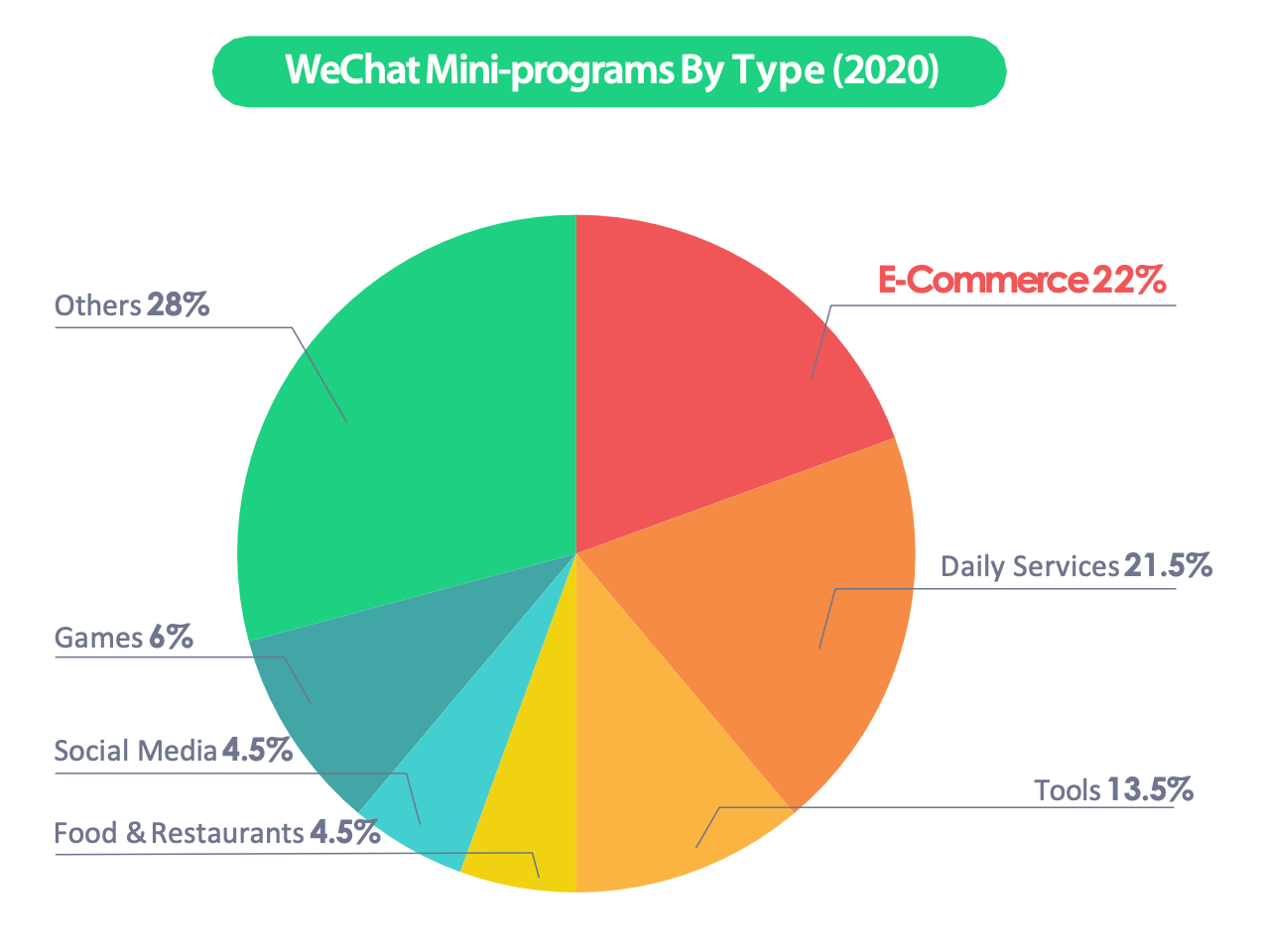

E-commerce is the biggest single category for mini programs, accounting for 22% of the total, followed closely by daily services (21.5%).

Social sharing remains the top way that users access WeChat mini programs (63.2%), followed by the drop-down navigation menu (19%), and QR codes (7.3%).

The vast majority (71%) of e-commerce mini program users are female and age 30 and under (60%).

Video use has seen the greatest growth in monthly average users, up nearly 72% year-on-year as of June 2020, and the livestreaming function introduced in February 2020 has been a game-changer for WeChat e-commerce.

Cat marketing 101: From Starbucks’ 2019 must-have paw mugs to Taobao’s recent hit cat-raising game for Singles’ Day, feline cuteness can be a powerful draw for consumer engagement. But could it be enough to save a troubled brand?

Coffee Box, a six-year-old startup that shuttered all of its stores and relaunched in September as an online-only brand, recently introduced a new line of bottled oat latte beverages with cats as the dominant marketing theme, from the line-drawings by Instagram-famous cat illustrator @dailypurrr on the packaging to an eight-hour livestreaming launch event with no human hosts, just cats who were available for adoption.

The brand also invited users to submit their cat photos on social media, with a contest to select three to be featured as @dailypurr drawings on the next batch of bottles. The campaign has generated a great deal of buzz on platforms such as Xiaohongshu, and the brand has also boosted consumer goodwill by offering to donate a portion of the proceeds from sales of the new drinks to an animal nonprofit.

Major trends in celebrity endorsements from 2020, via Socialbeta:

Domestic brand “champions” partnered with veteran celebrities who are considered as national idols, such as men's fashion brand Hailan House and Jay Chou, lingerie label Neiwei and Faye Wong, and C-beauty unicorn Perfect Diary and Zhou Xun.

Brands created celebrity avatars to represent their stars. A bit more special than regular virtual idols, creative representations of real-life stars were deployed to serve as dedicated brand ambassadors, such as a virtual Jolin Tsai for Absolut Vodka, Liu Tao’s character of Liu Yidao for Alibaba’s flash-sales platform Juhuasuan, and Jackson Yee avatar Qianmiao for Tmall.

Power to the people. Some brands experimented with allowing consumers to vote for brand representatives. Unilever and Tmall asked consumers to vote for a character from the Japanese manga series “Chibi Maruko-chan,” while Taobao Special Offer opened up a competition that any user could participate in.

Power in numbers. Instead of settling for one celebrity at a time, brands made a splash by announcing “all-star teams” of representatives. This approach was taken by Tencent Games with Honor of Kings and Game for Peace, as well as by Sprite in a deal with four different singers and bands.

News in English

Pinduoduo is the latest Chinese tech firm to roll out its own mobile payment system in a bid to draw market share from dominant players Alipay and WeChat Pay. KrAsia

JD.com is making a $700 million investment in Xinsheng Youxuan, a platform for group grocery shopping, but the red-hot sector is drawing greater scrutiny from Beijing amid a flurry of deals by China’s dominant tech players. KrAsia

E-commerce is forecast to make up 27.3% of China’s total retail sales next year, far exceeding levels predicted in the United States (16.2%) and the United Kingdom (19.9%). GroupM

But despite previous predictions, China will not surpass the United States as the world’s largest retail market this year. Emarketer

Chinese soccer teams will be forced to drop brand sponsors from their names, according to new rules issued by the Chinese Football Association over the objections of teams and their corporate supporters. Sixth Tone

Digital, casual, and “too cool” were among the top trends in China’s fashion scene in 2020. Radii

The huge potential in tiny toys: The Chinese craze for limited-edition, blind-box collectibles has spawned an industry worth billions, led by Pop Mart. Dao Insights

With the all-important Lunar New Year marketing season approaching, foreign brands must learn to strike the proper tone in the cultural communications to avoid rubbing consumers the wrong way. Warc

How the 150-year-old beer brand Amstel is adapting to Chinese tastes for its entry into the market. The Drum

The trendy tea chain Chayan Yuese has made a name for itself in a crowded field through extreme localization and entertaining content that speaks to young consumers. China Marketing Insights

We’ve Got China Covered

China Film Insider: China’s Top Female Directors Join Force for “HerStory”

Jing Daily: Are Suning Group’s Money Woes a Concern for China’s Online Retail?

Jing Culture & Commerce: How Museums Can Benefit From Partnerships in 2021