Future Tech China: Alibaba’s Walled Garden Is Crumbling

Plus: Trump's last-ditch effort against Alipay, early Lunar New Year ads, and a PR crisis for Pinduoduo.

Published three times per week, the Content Commerce Insider newsletter highlights how brands create content to drive revenue, globally. If you have received our newsletter from a friend or colleague, we hope you will subscribe as well and follow us on LinkedIn and Instagram.

Happy new year! Things are looking up for brands in 2021, but not so much for China’s tech giants. Here's why:

China's top market watchdog began an anti-monopoly probe into Alibaba. Alibaba's stock came crashing down on the news, losing 8% in a day on Christmas Eve. It looks like Alibaba's walled garden is crumbling. So why is that good for brands?

The Alibaba-Tencent duopoly suffocates small start-ups. They're often forced to choose between one of the two.

The same goes for brands. It’s called “forced exclusivity” — but that practice may come to an end soon.

The relationship between brands, consumers, and tech platforms can be complicated — they all need each other and the dynamics are constantly shifting. A small platform with no users has no power, and the opposite is true: a big platform with many users has lots of power.

What's happening now is that the power dynamic is increasingly shifting in favor of the latter type: the platform facilitates almost all consumer traffic, so it's in the brand's interest to play nice.

But what is to be done if platforms make unreasonable demands? What if, for example, if Tmall threatens to boot a merchant from its platform if it sells on Pinduoduo as well? Before last week, not much.

Duopolies Suffocate Innovation

Alibaba and Tencent are like two senior executives fighting in a conference room. You can't really contribute. Or break them up. They're taking up all the oxygen and there's not that much you can do about it but stand idly by.

The two firms have done a tremendous job of creating market value by building sleek, helpful, and even — dare I say — thoughtful online experiences.

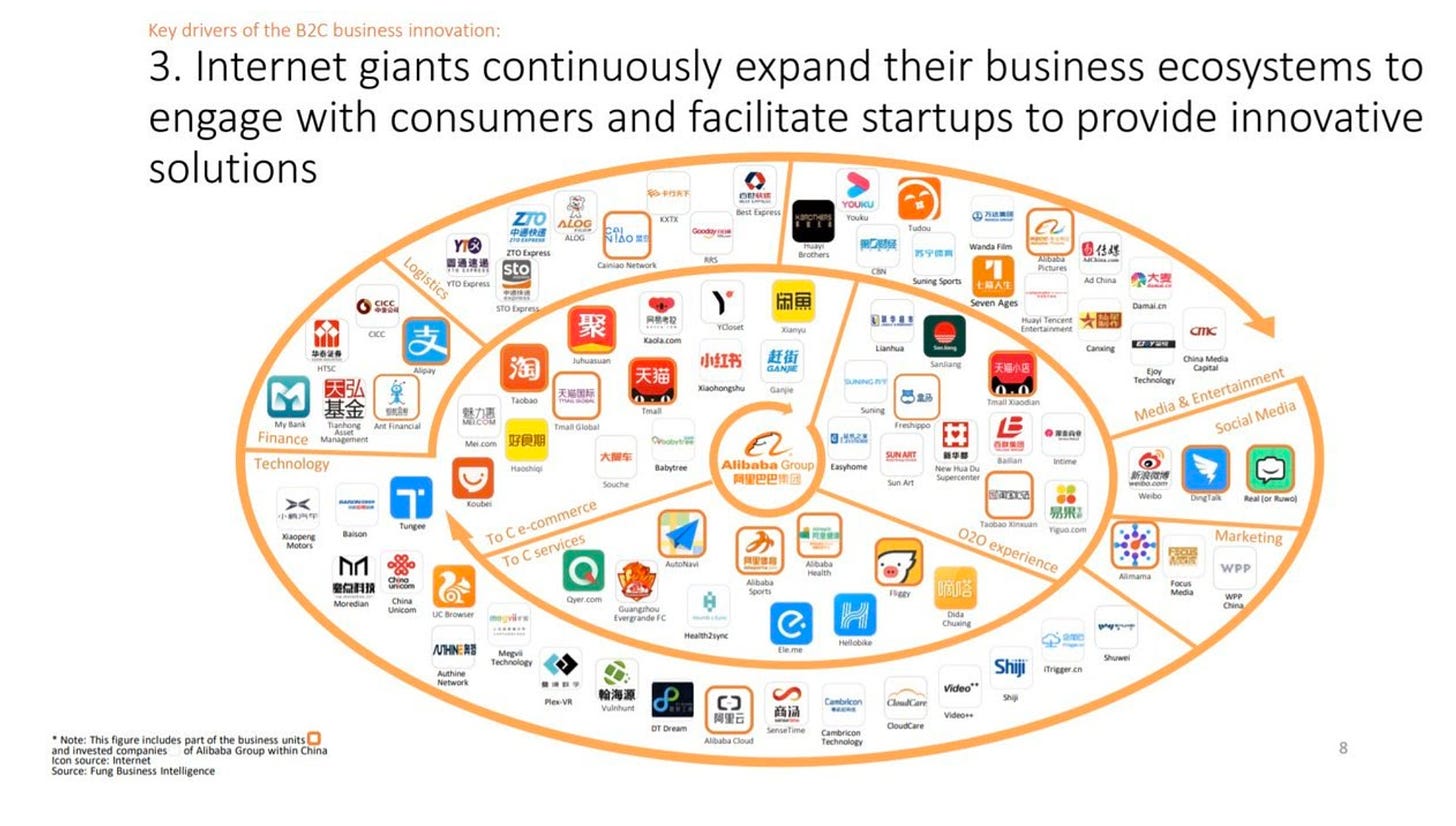

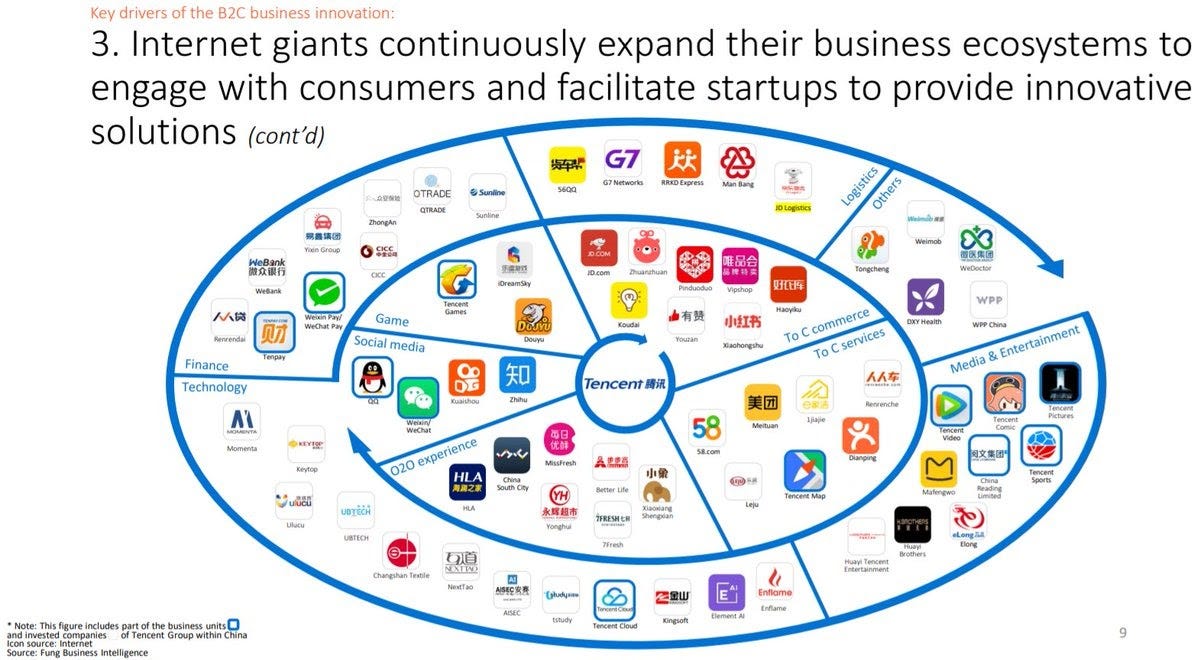

But they've also created a situation where it's become near-impossible for start-ups to thrive without picking a side via accepting investment. I would love to fully explain the Alibaba-versus-Tencent ecosystem, but considering that you would also like some free time in 2021, I’ll refrain. Instead, have a look at these two graphics that illustrate how they work.

Yes, it looks like a mess, and that’s because both Alibaba and Tencent have made it their business to fight shadow wars in every sector that is vaguely relevant to a broad definition of "tech,” and they've been pretty good at it too.

We could create similar graphics for brands. Most brands focus their efforts on either Alibaba-owned Taobao and Tmall or JD.com. And there's a reason for that.

Forced Exclusivity

It's long been an open secret in China e-commerce that e-commerce platforms often engage in "forced exclusivity,” demanding that brands choose between competitors. In Chinese this is also referred to as erxuanyi (二选一), which loosely translates as “pick one of two.” This is exactly the focus of Beijing’s anti-monopoly probe. Alibaba's practice of "forced exclusivity" means that merchants have been required to opt out of selling on rivals such as JD.com or Pinduoduo and commit exclusively to Taobao or Tmall.

Half a decade ago, Alibaba leveraged a similar policy to prevent fashion brands on Taobao from selling on JD.com. As a result, JD.com’s apparel business never really developed, according to an executive from tech-focused think-tank Hatun.

Is Tencent Next?

Last year, Tencent argued that it “doesn't hold a dominant position in the instant-messaging market” on the basis that no such market even existed due to the dynamic characteristics of China’s internet. It prevailed and the case was dropped due to “lack of evidence.”

China has been making efforts to overhaul its 11-year-old anti-monopoly law, and in November issued draft guidelines on the “platform economy,” including how to recognize a monopoly (aka 2020's favorite tech game). The draft states that a market could be determined by “how hard it is for users to switch platforms,” with parameters for determining market share including transaction volume, user base, and page views. Alibaba was first to be singled out, but I suspect Tencent will be next, given that it has effectively banned Alibaba from its platforms, making it difficult for users to share Taobao or Tmall links over WeChat. This may now change too.

Further thoughts

Over the weekend, Alibaba-owned Ele.me quietly made WeChat Pay available to users of its app. On a similar note, Tencent-backed Meituan added Alipay as a payment option. Unprecedented — and great for consumers.

Bytedance is a complete exception when it comes to not having picked a side. And they’re better for it, and now big enough to be a competitor in its own right.

Merchants say China’s e-commerce giant pushes them off its Tmall platform if they use rival, Financial Times, January 2020

- by Tanya Van Gastel

Mentioned in today’s newsletter: Alibaba, Tencent, TikTok, Alipay, Bytedance, Ele.me, Pinduoduo, Zhihu, JD.com, Pepsi.

CCI Take: Trump’s Last-Gasp Alipay Ban Likely to Fizzle Out

by Avery Booker

Just two weeks before he’s due to leave office, Donald Trump signed an executive order banning transactions with eight Chinese software applications, including Ant Group’s Alipay mobile payment app, in a move that is likely aimed at cementing Trump’s “tough-on-China legacy” before the January 20 inauguration of Joe Biden.

The order argues that the U.S. must take “aggressive action” against Chinese apps in the name of national security. In addition to Alipay, the order calls out Tencent’s QQ Wallet and WeChat Pay, CamScanner, SHAREit, Tencent QQ, VMate, and WPS Office, and gives the Commerce Department a 45-day deadline to decide which transactions will be banned.

From a PR perspective, the move could be somewhat damaging to Alipay for the next couple of weeks, perhaps limiting the number of purchases made by Chinese consumers at the more than 175,000 U.S. retail locations where it is accepted. However, it is also likely that the executive order will fizzle out, as Trump’s much-publicized crusade against TikTok, or result in ongoing confusion, as seen with the New York Stock Exchange’s latest indecision over whether to delist China’s major telecom firms. In any event, this week’s ban on app transactions is likely to either be revoked by Biden or simply not implemented by the incoming administration.

Unlike TikTok, which now boasts approximately 80 million American users, WeChat Pay and Alipay have not been widely adopted in the United States, and are mainly used by Chinese expats, travelers, and students. It’s simply a hard argument to make that these payment apps threaten the data privacy of a large number of Americans.

Read the full article on Content Commerce Insider

Brand Collab Pick: Pepsi and Ele.me Bring the Lunar New Year Joy

As China gears up for the biggest marketing season of the year in the period that surrounds the Lunar New Year (February 12 in 2021), brands across the consumer spectrum will step up their efforts on special limited-edition holiday gifts, collaborations, and content, especially via branded films.

Since 2012, beverage giant Pepsi has run a recurring Lunar New Year marketing campaign called “Bringing Happiness Home,” incorporating productions with A-list celebrities that creatively align the traditional holiday narratives of family gatherings with Pepsi products. Among the most popular of these was Pepsi’s 2017 film reuniting the cast of the hugely popular mid-2000s sitcom “Home With Kids” (家有儿女), while last year’s edition starred the popular young actress Zhou Dongyu in an entertaining caper to hunt down a mouse in the house (it was the Year of the Rat).

This year, Pepsi is partnering with the Alibaba-owned Ele.me to boost the impact of its “Bringing Happiness Home” campaign, and invited actor Pan Yueming to produce and star in a short film for the two brands. Integrating Pepsi products with the now-heroic character of an Ele.me delivery worker, whose dedication to the job includes working on the eve of the Lunar New Year, the film is a heartwarming family story that puts a new spin on the concept of bringing happiness home.

Both the packaging of Pepsi’s signature beverage and the Ele.me worker’s uniform and helmet are in shades of blue, lending a strong visual element to the partnership as well. An accompanying mobile game in which users can play to send cans of Pepsi to real-world Ele.me workers, who are known as “blue knights.”

News From China

The year 2020 saw the spectacular rise of the discount-oriented e-commerce platform Pinduoduo. The company boasted more than 730 million annual active users in the third quarter of 2020, when it also reported quarterly revenues of RMB 14.2 billion ($2.1 billion), representing an 89% year-on-year increase and allowing it to record its first quarterly profit since listing on Nasdaq in July 2018. Its stock price has surged, more than quadrupling over the course of 2020, and the company has been seen as a major beneficiary of Beijing’s increasing scrutiny of Alibaba, China’s dominant e-commerce player.

But now it looks like Pinduoduo could become another target for investigation, as the high-flying tech company finds itself in the midst of a PR crisis following the death of a 22-year-old female employee who collapsed after a work day that ended well after midnight. The incident has put China’s infamous “996” (9 am to 9pm, six days a week) work culture back into the spotlight, with authorities in Shanghai (where Pinduoduo is headquartered) reportedly launching an investigation.

Pinduoduo only made matters worse with a poorly worded statement it posted on Zhihu, China’s leading Q&A platform, in which it dismissed the incident as par for the course in a world where the poor must “trade their lives for money.” Pinduoduo has tried to deny its direct involvement in the statement, even after Zhihu confirmed that it came from the company’s official account, which has since been slapped with a 15-day suspension by the platform.

State media is also piling on, with broadcaster CCTV and news agency Xinhua publishing comments railing against China’s overtime culture and emphasizing the importance of protecting workers’ rights.

News in English

Already the world’s biggest retail market, China is poised to become the world’s largest apparel market by 2023, and it will do so on its own terms as it reshapes the fashion landscape. WWD

Video platform Bilibili could be the next internet company to launch its own mobile payment system, following a recent slew of similar moves from Bytedance, Pinduoduo, Meituan, and Didi to challenge Alibaba and Tencent’s dominance in the sector. Pandaily

Bilibili is also reported to be planning to raise $2 billion in a secondary listing in Hong Kong, although the company has declined to comment. KrAsia

Though he hasn’t been seen in public since October, Alibaba’s Jack Ma is not “missing” — he’s just laying low amid increasing government scrutiny of the business empire he founded. CNBC

The New York Stock Exchange has been flip-flopping on plans to delist three major Chinese telecom firms, sowing confusion in the markets and highlighting ambiguity in President Trump’s executive order to bar U.S. investment in companies with ties to the Chinese military. Bloomberg

Amazon will be forced to stop using the AWS logo in China after losing a trademark case, and will also have to pay nearly $12 million in compensation to ActionSoft Science & Technology Development, which had registered the mark first. Wall Street Journal

Luxury e-commerce retailer Farfetch shuttered its store on JD.com as it prepares to move onto Tmall as part of a $1.1 billion deal it made with Alibaba and Richemont. KrAsia

Five successful case studies on influencer marketing in China, from fast food to fashion and beauty. Parklu

Beijing has adopted a 21-day quarantine for anyone entering the Chinese capital from abroad as cases of Covid-19 are on the rise in the region. Sixth Tone

Chinese heritage meets “all that stuff by the counter at Urban Outfitters”: The pricey reimagining of mah jong sets by an American brand fueled charges of cultural appropriation and a lack of respect for the game. Radii

We’ve Got China Covered

China Film Insider: Pixar’s Animated Film “Soul” Winning Both Hearts and Box Office in China

Jing Daily: Meet China’s New, Young Luxury Heroes for 2021

Jing Culture & Commerce: DHL and Van Gogh Museum Partner for a Unique Shopping Experience