CCI Q&A: Nick Cakebread on China’s Year in Content Commerce

Plus: Designer DTC, Bilibili makes peace with 2020, and JD.com's latest content-commerce innovation.

The Content Commerce Insider newsletter highlights how brands create content to drive revenue. If you have received our newsletter from a friend or colleague, we hope you will subscribe as well and follow us on LinkedIn and Instagram.

As 2020 draws to a close, Content Commerce Insider has been catching up with leaders in their fields to share reflections on this transformative period as well as predictions for what comes next. In the second installment of our year-end Q&A series, we caught up with Nick Cakebread, founding partner of integrated luxury agency Gusto Luxe and Gusto Collective, which brings together best-in-class marketing and digital agencies.

With 20 years of experience in marketing, communications and advertising, Cakebread has held senior roles on the agency and client side, spanning London, Beijing, Shanghai and Sydney, and has worked with global clients such as LVMH, P&G, Unilever, Burberry, and The Walt Disney Company.

CCI: When the Covid-19 pandemic spread throughout China in early 2020, we saw brands, TV producers, and marketers move their efforts and programming onto the cloud. Do you feel that this trend is here to stay, or will offline events and marketing get back to normal in 2021?

Nick Cakebread: China has been particularly fortunate in that it’s one of the few places in the world where offline events are taking place, and have been since around May of this year. While many companies were forced to operate solely via digital in the first several months of the year, bolstering their cloud and tech capabilities, most have already returned to normal, with staff all back in the office, and events taking place offline. However, the fact remains that many companies in China rely heavily on interaction with global teams and clients, but because of travel and quarantine restrictions are still having to find digital solutions to cooperate with overseas stakeholders. With vaccines still a ways off, and as companies realize that not all business travel is essential, I believe this is a trend which will permeate the business environment long past 2020.

CCI: What would you say has been the most exciting consumer trend you’ve seen in China this year?

Cakebread: Some of the most notable consumer trends in China this year aren’t necessarily new, but were heavily accelerated during the first quarter of the year when China was experiencing the peak of the pandemic. One of the trends we’re most excited about is an acceleration of consumers’ awareness and preference for sustainable brands. The pandemic was a big wake-up call for Chinese luxury consumers on the important role their purchases can play in the health and well-being of themselves, and the world. Brands should understand that being sustainable is not just important for business and reputation, but it can also play an integral part in driving affinity and sales.

CCI: Can you tell us about a couple of the biggest success stories for your firm this year and how they came about?

Cakebread: 2020 was a big year for us, after ten years of being Reuter Communications, Founding Partner Chloé Reuter and I joined industry veteran Aaron Lau as founding partners in Asia’s first brand-tech holding company, Gusto Collective. Gusto Collective acquired Reuter Communications to become Gusto Luxe, where Chloé and I still hold our titles as Founding Partners.

Gusto Collective sits at the intersection of the dramatic growth in the digital and tech revolution, providing solutions for brands to harness the power of storytelling and technology to create and share content. It is no secret that our industry, especially in APAC, is constantly changing, and we’re firm believers that technology is powering this growth.

In addition to becoming Gusto Collective, we also launched our dedicated Sustainability Solutions. Sustainability is the new luxury in China and Asia, whether in travel, fashion, jewelry, or lifestyle, and it plays an increasingly important role for our brands in this region. As a business we want to ensure our clients are at the forefront of this meaningful change, and that we are supporting them, whether sustainability is one of their key pillars, or whether they are embarking on their drive for positive change.

CCI: This year we have seen content-commerce strategies like livestreaming e-commerce, brand films, brand-funded programs, and brand collaborations proliferate. Do you think these types of strategies are underrated or overrated?

Cakebread: The fact of the matter is, e-commerce livestreaming has been one of the most successful ways for brands to engage and drive sales this year. While livestreaming is not new, because of the pandemic, we saw many more brands forced to pick it up, particularly luxury brands that had previously been averse to livestreaming. Livestreaming shifted from being a more theatrical, entertainment-driven medium to a way for brands to demonstrate their expertise and efficacy of their products and build deeper connections with more consumers.

For our clients, nearly every major campaign we’ve run this year has involved livestreaming, brand-funded programs, or brand collaborations, often in some combination. As China’s social media platforms become increasingly e-commerce-capable, our emphasis is on driving content to commerce.

CCI: With the rise of Gen Z as an increasingly powerful consumer demographic, and the decentralized way they consume media (often via short video apps like Douyin/TikTok), what are your thoughts on how brands should approach influencer and peer marketing to reach and influence younger consumers?

Cakebread: For many Post-90s consumers in China, discovery of a new product or brand begins by seeing it in the hands of a trusted influencer, then they will turn to platforms like Xiaohongshu (Little Red Book) or WeChat for customer/peer reviews, [and then] the journey can continue on Tmall/Taobao, Baidu, and more. So for brands, working with an influencer is only part of the strategy to influence younger consumers, and celebrity is often no longer as effective as it was.

Working with a multitude of smaller micro-influencers across multiple platforms has become much more powerful for brands to reach this young consumer group who are increasingly brand-savvy and unswayed by just a logo — they want to know how the brand can help define their own story, and how that product and brand fits into their lifestyle and makes them unique.

CCI: Increasingly we’re seeing “made-in-China” trends (and apps like TikTok) expand internationally. Which recent trend or trends do you expect to go global in 2021?

Cakebread: China has led the way with regards to social commerce, nearly every “social” platform is equipped with e-commerce features, and vice versa. Facebook has been playing catch-up for years, albeit not so successfully. However this year, as the pandemic hit businesses hard, we saw Facebook scramble to release a better shopping experience through Facebook and Instagram shops — while still nowhere near as seamless a user experience as, for example, shopping via WeChat. As Western consumers become more comfortable with mobile shopping through social platforms I believe we’ll start to see brands take an approach in global markets that is more akin to the digital strategies we’ve been deploying in China for several years now, driving content to commerce.

CCI: With the rise of Bilibili, Kuaishou, Pinduoduo, and others, do you have any insights into how WeChat has been evolving to withstand the competition from other platforms?

Cakebread: WeChat has always been a very closed, network-driven platform, making it incredibly difficult for discovery and to grow a large audience. Even though WeChat pioneered the concept of mini programs, in many ways it is still lagging behind when it comes to video, livestreaming, and e-commerce livestreaming capabilities. However, this year, largely driven by the pandemic, we saw many changes in WeChat including Channels, mini program livestreaming, Channels livestreaming, and the testing of new features such as hashtags, Channels e-shops, and more, signaling that WeChat is feeling the pressure applied by apps such as Bilibili, Kuaishou, Douyin etc., which are leading in today’s most popular and effective medium — video. While WeChat still remains one of the top channels customers prefer to hear from brands on, we’re looking to apps to continue testing and rolling out new features to stay competitive, whether those will be successful remains yet to be seen.

Thank you to Nick Cakebread and Gusto Luxe, and a special thanks to Olivia Plotnick for facilitating this Q&A.

- by Avery Booker

Mentioned in today’s newsletter: Anine Bing, Bilibili, Celine, Comme des Garçons, Everlane, Fashion Nova, Genki Forest, Instagram, JD.com, Kuaishou, Naadam, Perfect Diary, Prada, Raf Simons, Reformation, Sézane, The RealReal, TikTok, Vestiaire Collective, WeChat, Xiaohongshu, Yongpu Coffee.

Luxury Look: 2021 Could Be the Year of “Designer DTC”

by Avery Booker

In many ways, 2020 represented a turning point for direct-to-consumer (DTC) brands, particularly in China, as housebound consumers turned to e-commerce and digitally native (or online-only) brands made further investments in marketing to launch collaborations with similarly “internet-famous” celebrities, designers, and influencers. In the West, fast-fashion companies such as Fashion Nova aggressively chased Gen Z consumers via TikTok and Instagram, while more premium DTC brands like Sézane, Reformation, and Everlane appealed to millennial consumers who were adjusting to more casual, work-from-home routines.

In China, DTC brands such as Perfect Diary, Genki Forest, and Yongpu Coffee have burst into the mainstream by spending heavily on marketing efforts that included everything from the appointment of international spokespersons to sponsorships of television programs and partnerships with fashion-focused social networks.

Meanwhile, a growing number of DTC brands and platforms worldwide are looking to enter the luxury segment, using a digital-first roadmap that bypasses the typical time-intensive, brick-and-mortar route to building a high-end brand. From the Los Angeles-based Anine Bing to cashmere brand Naadam to Senreve, which boasts Italian-made handbags from the same factories used by the likes of Celine and Fendi, DTC luxury is quickly becoming a crowded space — though it remains to be seen if these young brands will achieve the same kind of brand equity built over the years by their traditional luxury counterparts. A handful of more established high-end brands have also experimented with DTC as an avenue for their diffusion lines, among them Comme des Garçons’ CDG.

But one area that has yet to fully take shape in the luxury market is “designer DTC,” in which a recognized individual launches his or her own digitally focused, direct-to-consumer brand or platform. Naturally, many of the world’s top luxury designers and creative directors lack the bandwidth or the interest in doing this, given their busy day-jobs, but there are signs that it is an area ripe for growth.

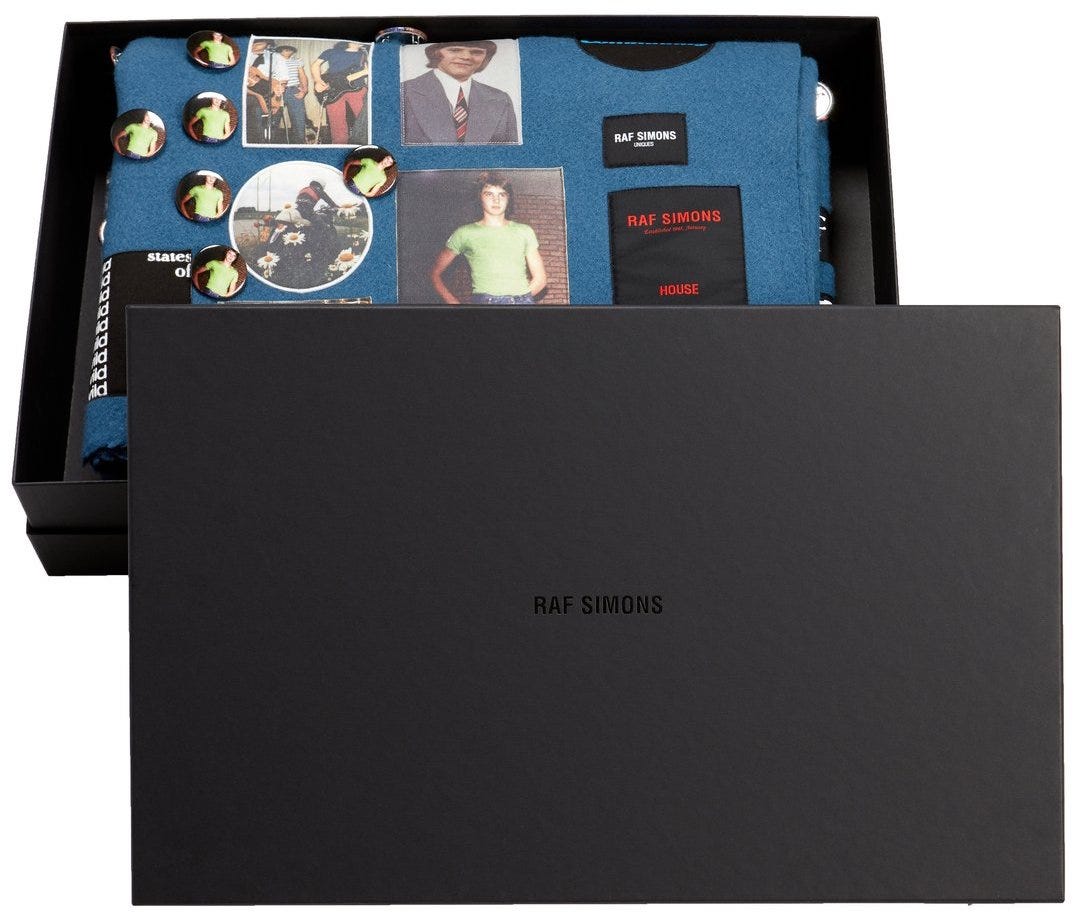

This month, Raf Simon, the Belgian trendsetter and Prada’s co-creative director, launched one of the first examples of designer DTC with a personally branded online store and multidisciplinary platform, History Of My World. Kicking off with an already-sold-out collection of one-of-a-kind blankets created by the Raf Simons studio, the DTC site “offers a curation of pieces selected by Raf Simons” that reflect his “point of view, aesthetic, and philosophy.” Spanning everything from home decor to literature and clothing, the site — which takes great pains to point out is distinct from the Raf Simons brand — will eventually sell limited-edition items, special collections, and unique pieces.

Giving Simons a new opportunity to monetize his global fan base, “History Of My World” is a potential blueprint for other luxury designers looking to do the same. For many “free agent” designers — whether in between creative director gigs or working on their own lines — a DTC outlet could be a good way to leverage the currency their names carry by selling archive pieces, one-off designs, limited-edition collaborations, or even run-of-the-mill memorabilia.

As the rabid searces for anything from the Phoebe Philo era at Céline on resale platforms like The RealReal or Vestiare Collective show, some designers are brands in themselves, and are just as sought after as the labels that hire them. It thus makes sense for more entrepreneurial designers to take advantage of that. After a roller-coaster year that should make anyone question the wisdom of investing in traditional stores and modes of advertising, DTC could become less of a dirty word in the luxury business in 2021 and beyond.

Brand Film Pick: Bilibili Makes Peace With 2020

The youth-oriented video platform Bilibili has big content plans for the year ahead, starting with its much-anticipated New Year’s Eve gala show, which will air on state broadcaster CCTV as well this year. But first, a look back at the unforgettable year of 2020 is in order. In addition to growing its user numbers and boosting its original content, and cementing its status as a key player in China’s video market (for viewers, content producers, and brands alike), 2020 has seen Bilibili produce a strong run of branded films that have both appealed to its core demographic and broadened awareness of the platform among a wider audience (sometimes to the chagrin of OG users).

Incorporating elements of science fiction, cyberpunk, and anime, Bilibili’s year-end film “Undo No More” (不再撤回) works as a savvy promotional video for its upcoming New Year’s Eve show. The three-minute film anthropomorphizes 2020 into a young, white-haired man who, as he looks back at the events and losses that occurred (from Covid-19 to Kobe Bryant’s death to the Australian wildfires), considers deleting the entire year with the press of “CTRL+Z” on a handheld computer/controller. But as he is about to, a chorus of voices in various languages reassures him that it’s okay, and the format shifts from live action to animation as a hopeful message is offered to encourage acceptance of what has transpired and the ability to face the future on its own terms.

The video has generated a good deal of buzz for Bilibili, with nearly 3.4 million views on the platform and its Weibo hashtag drawing more than 25 million views, with eagle-eyed viewers seeking out the numerous Bilibili-related easter eggs placed throughout, from the platform’s TV-headed mascot (sketched on a sticky note) to a bamboo prop from the hit anime series “Demon Slayer” (鬼灭) to the coveted plaque awarded to creators who hit the million-follower mark. The popular beverage brand Genki Forest also makes an appearance, quite aptly as it is also the title sponsor for the upcoming New Year’s Eve show.

News From China

As part of its Singles’ Day campaign, e-commerce giant JD.com took an innovative content-commerce step by launching a livestreamed “season 3.5” of Tencent Video’s comedy competition “Rock & Roast” (脱口秀大会) to promote the weeks-long sales event, effectively creating a spin-off of a popular show aimed at boosting the JD.com brand. More recently, it benefited from a similar tactic in reverse via iQiyi’s “prequel” for the upcoming seventh season of the uber-popular celebrity talk show “I Can I Bibi” (奇葩说), for which JD.com is the title sponsor.

The special episode, which aired on iQiyi on December 17, featured among its guests actress Yang Mi (known as the “goddess of goods” for her commercial power), TV host Kevin Tsai, and Didi president Jean Liu, and was staged as a search for participants from all walks of life (including employees of the show’s brand sponsors) and deep integration for JD.com in particular, which is working with other brands to add entertainment value to the show and translate that into cross-channel marketing that will drive revenues.

The online luxury platform Secoo is boosting its in-house e-commerce livestreaming capabilities with the launch of a broadcast base in Beijing, a three-story studio/warehouse building that can accommodate up to 300 livestreamers working simultaneously. Secoo has reportedly enlisted some 3,800 brands to participate in the project and plans to open more livestream bases around the country.

Recently two of China’s top e-commerce livestreamers, Xinba (on Kuaishou) and Luo Yonghao (on Douyin) have been embroiled in scandals over sales of fake or counterfeit products. A key figure in the crusade against counterfeiting in China has been Wang Hai, a consumer advocate who has been fighting fakes for the past 25 years, and now he is taking livestreaming to task for questionable practices such as false advertising, fake sales, and conflicts of interest.

Luxury brand collaborations and limited edition have seen demand from young consumers soar, with a 300% to 400% increase in sales to Gen Z shoppers during the first 10 months of 2020.

News in English

Chinese e-commerce livestreamers are working to boost exports via Facebook, Amazon, Instagram, along with more familiar channels such as AliExpress. Sixth Tone

Tencent is exercising its option to increase its holdings in Universal Music Group, leading a consortium for another 10% stake that values the label at $37 billion. Reuters

Alibaba’s $926 million investment in Mango TV’s parent got the green light from regulators, which could see closer ties between the Alibaba-owned Youku and Mango TV and content-driven e-commerce across platforms. Variety

From livestreaming to new store openings to emerging lower-tier cities, how China helped save 2020 for luxury brands that picked the right local marketing strategies. WWD

Gucci is the latest global designer brand to hop on the Tmall Luxury Pavillion bandwagon, a move that comes as it drops a counterfeiting lawsuit against Alibaba. Fashion United

The 116-year-old denim brand Wrangler is entering the Chinese market through a partnership with Tmall. Inside Retail

A podcast deep dive into C-beauty brand Perfect Diary and recently IPO’d parent Yatsen, including discussion of its marketing success and the evolution of Chinese content commerce. Tech Buzz China

Chinese appetites for extreme brand collaborations reached a new level of weirdness with McDonald’s Oreo x Spam burger, which has been roundly panned on social media. Radii

Follow-up flop: Though hotly anticipated, Mango TV’s male counterpart to the summer’s hit 30-over-30 female talent competition “Sisters Who Make Waves” has been widely criticized for its poor quality (“Awkward, embarrassing, super cringey”), forcing producers to ditch plans to create a supergroup from the participants. Radii

Top Kuaishou livestreamer Xinba has come under fire not only for selling fake bird’s nest, but also for sharing the personal contact info of a consumer who complained about the product, leading to her online harassment. Sixth Tone

Shanghai is promoting a two-month-long shopping season that will span both the Western and Lunar New Year periods, with dozens of marketing events and offline campaigns. Shine

It’s official: Trump has signed a bill into law that could see U.S.-listed Chinese firms kicked off American exchanges if they fail to comply with auditing requirements (which hardly any do). CNBC

We’ve Got China Covered

China Film Insider: Launch of Video Game Rating System Prompts Calls for Film Rating System Along Similar Lines

Jing Daily: China’s Most Controversial Fashion Incidents in 2020

Jing Culture & Commerce: Top 10 WeChat Posts by International Museums in 2020