Best of Brand Collaborations: October 2020

Plus: TV producers chase China's "she economy," Sotheby's takes on luxury e-commerce, and Audi angles for Gen Z.

The Content Commerce Insider newsletter highlights how brands create content to drive revenue. If you have received our newsletter from a friend or colleague, we hope you will subscribe as well and follow us on LinkedIn and Instagram.

In China’s marketing scene, brands in just about every sector have shown great openness to partnership opportunities capable of expanding their reach beyond those already familiar with their core products. Foreign and domestic brands alike may seek to tap into elements of Chinese culture, whether ancient or modern, to boost their profiles among consumers seeking novel mash-ups.

So with that in mind, here is our list of best brand collaborations from October 2020:

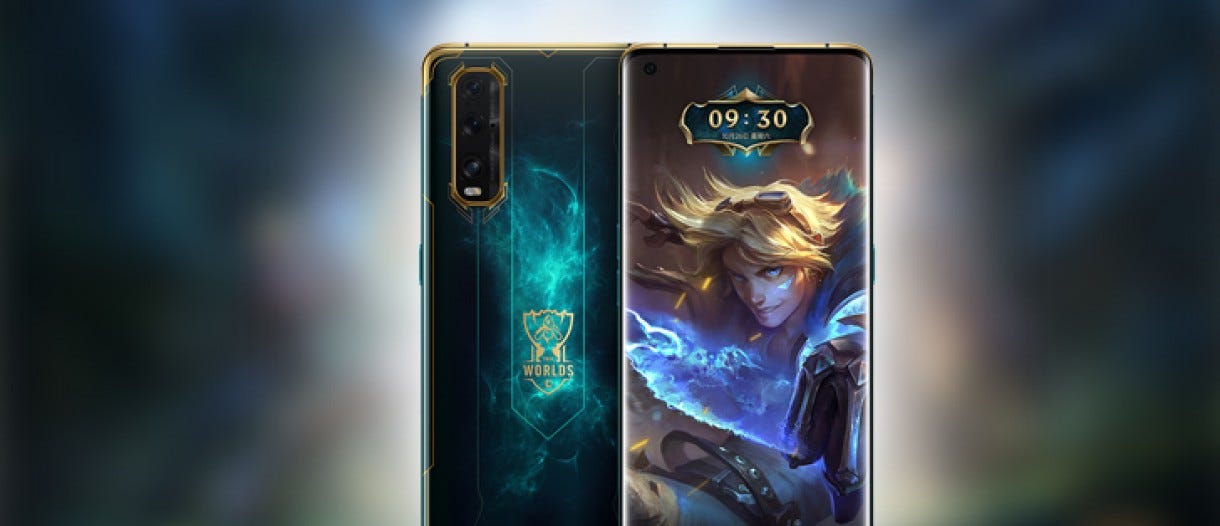

Top Pick: Oppo x League of Legends

The hit multiplayer online game League of Legends has drawn an enviable roster of brand partners from around the world for the 2020 World Championships, among them Mercedez-Benz, Spotify, Mastercard, and Bose. But when it comes to brand collaboration, one of the strongest showings was made by mobile phone sponsor Oppo, combining a jointly branded, limited-edition product with entertaining content that had a major impact among LoL fans.

A number of LoL brand sponsors, including Oppo, were featured in the music video for “Take Over,” its official theme song for this year’s championships, which concluded on October 31 in Shanghai.

But going a step further, Oppo produced its own music video to promote a limited-edition Find X2 handset collaboration created for the world championships (an image of the phone was teased in the “Take Over” video). “Be the Legend” (英雄登场), sung in English by Tia Ray, drew rave reviews from fans inside and outside China who prefer Oppo’s branded song and video over the official selection.

Oppo’s video subtly incorporates the brand through both lyrics (“Find X/ Find more”) and visual elements such as the large X that appears in the sky at the end, and the commercial aspect hasn’t deterred viewers. Since its release on October 12 (exactly one week before the launch of the limited-edition phone), the video has been viewed more than 3.2 million times on Bilibili and its hashtag has made 230 million impressions on Weibo.

Five more noteworthy collaborations from October 2020:

Florasis x Miao Ethnic Culture

Beauty collaborations are hugely popular in China, creating a more competitive environment for any single one to stand out. C-beauty brand Florasis (also known by its Chinese name, Hua Xizi) tapped the heritage of China’s Miao Ethnic Culture and its silver craft traditions to create a line of visually stunning, ultra-premium products that were promoted by China’s top beauty livestreamer Li Jiaqi.

Perfect Diary x China Aerospace

Another top C-beauty brand made waves with a China-focused partnership, this one focused on the future instead of traditional heritage. Cosmetics unicorn Perfect Diary worked with China Aerospace on a limited-edition release for the Mid-Autumn Festival, which this year happened to fall on October 1, China’s National Day. The collaboration — facilitated by Tmall’s Guochao (“national trend”) brand incubator — merged holiday traditions (via the mythology of the jade rabbit) and national pride in China’s science and technology breakthroughs with one of Perfect Diary’s signature animal-inspired collections.

Karl Lagerfeld x Tsingtao Beer

After partnering with KFC to celebrate the 80th anniversary of its original recipe fried chicken, Karl Lagerfeld scored another surprising China collaboration with the country’s best-known beer brand, Tsingtao. The black-and-white “night owl” Muse collection included limited-edition bottles featuring cartoon images of Lagerfeld and his cat Choupette, beer cooler bags, and dishes.

Jean Paul Gaultier x Bosideng

French designer Jean Paul Gaultier has renewed a partnership with Chinese outdoor brand Bosideng for a second year with a new premium down collection. It’s a win-win for both sides, as the collaboration helps to expand the European fashion label’s presence in China while helping to boost the Bosideng’s brand image and its efforts to become a global name despite previous setbacks.

WWF x Tencent Music Entertainment

Bringing together the fields of music, art, and the natural world, the World Wide Fund for Nature (WWF) partnered with China’s biggest online music platform to stage an interdisciplinary exhibition titled "All Creation: Encounter with Animals” at Beijing's UCCA Center for Contemporary Art. The show paired recordings by eight musicians with works by eight visual artists, with a collaborative album planned to promote environmental preservation.

Mentioned in today’s newsletter: Alibaba, Audi, Bilibili, Bose, Bosideng, Bytedance, Florasis, iQiyi, Jean Paul Gaultier, KFC, Karl Lagerfeld, Kuaishou, Mango TV, Mercedez-Benz, Mastercard, Oppo, Perfect Diary, Sotheby’s, Spotify, UCCA.

“She Reality” Programming Targets Valuable Consumer Demographic

by Ginger Ooi

China’s “she economy” (她经济) has long been a force to be reckoned with — spending by Chinese women increased by 81% between 2014 and 2019 to $670 billion, and women play a crucial role in making decisions about household spending. There also remains strong potential for increased consumption as women’s incomes continue to rise, narrowing the gap with men’s.

This year has seen the major satellite networks and video platforms appearing to have caught on to the power represented by female viewers. We’ve seen a marked increase in programming targeted specifically to women with dramas such as the summer’s big hit, “Nothing But Thirty” (三十而已) and the rising trend of female-focused content known as “she reality shows” (她综艺).

This female-oriented format can offer brands numerous opportunities to appeal to various female demographics, and she-reality looks set to become a regular part of the lineup in the year ahead, as streamers and networks announce their plans for 2021, including the return of Mango TV’s breakout “Sisters Who Make Waves” (乘风破浪的姐姐) for a second season.

Hunan Satellite TV plans to air two new shows: “XL Beauty”(加大码美丽) and “Next Stop Happiness” (下一站幸福, not to be confused with the recent drama series of the same title). Each shines a light on groups of women that have traditionally been shunned in popular media: “XL Beautiful” will invite 24 plus-sized women to highlight their unique talents in a multi-stage competition, while the dating show “Next Stop Happiness” will pair four divorced female celebrities with male guests to see if they can find love once more.

Jiangsu Satellite TV and Alibaba’s Youku are collaborating to produce “Powerful Chinese Style” (超A古装女主角), a show focusing on the traditional aesthetics and clothing styles, such as hanfu, which are very popular among Gen Z. Sixty contestants will compete in multiple “challenges” involving looks inspired by Chinese costume dramas, and the potential for e-commerce integration through Alibaba’s shopping platforms is very strong.

iQiyi has she-reality shows planned for 2021: “De Tea Party for the World’s Girls” (世界美少女De茶话会), which will feature seven women from around the world discussing hot news topics from their home countries each week; “Sister Club” (姐妹俱乐部) will tap into the recent attention drawn by female comedians, with three comics in the regular cast performing skits on contemporary women’s issues, supported by special guests; comedians as fixed casts members as they perform sketches focusing on every modern-day women’s issues with the help of supporting casts actors; and “Go to Work! Moms” (上班啦!妈妈) will follow a group of mothers as they return to workplace and adapt to the new challenges they face in balancing work and family life.

The new wave of “she reality” programming falls into two types: general-interest that target women with potential appeal to wide audiences, and those that focus on more specific, and often marginalized, identities (plus-sized women, divorcees, and working mothers, for example). Production costs for these types of shows will be relatively lower than for popular formats such as big idol competitions and top talk shows, which means that brands can get in on sponsoring innovative and impactful content for less.

Meet the New Online Luxury Retailer: Sotheby’s

What’s bound to recalibrate Sotheby’s position within the luxury business is its digital buy-now marketplace. It’s where consumers may purchase artworks, as well as a host of luxury offerings including jewelry by Van Cleef & Arpels, fine wines, Birkin bags, and deluxe home furnishings, directly via the auctioneer’s platform. The inclusion of buy-now items such as modern and vintage sneakers further diversifies Sotheby’s luxury umbrella, building connections to millennial shoppers.

The demand for these non-traditional luxury items is clear. Notably, in May, Sotheby’s set a new auction record when it sold a pair of Michael Jordan’s game-worn Nike Air Jordans for $560,000. At the same time, Sotheby’s Hong Kong’s Contemporary Showcase series of pop-up auctions saw an intersection of vinyl toys, manga drawings, Western contemporary art, and other limited edition collectibles go under the hammer. The response was overwhelming: at Contemporary Showcase: MEET AllRightsReserved, in particular, the sale prices for items such as a set of KAWS plush toys and a Doraemon sculpture far exceeded estimates.

Evidently, this new luxury proposition carries further weight in China, where Chinese cultural consumers are eager to fill their budding collections with items equally luxe and niche. While legacy brand names do matter to these millennial buyers, they’re also keen to collect works rich with cultural cache, powered by hype, and limited in edition — and they have the discretionary income to do so. At Sotheby’s Hong Kong’s Contemporary Art Online auction in April, such buyers pushed the sales total over HK$10 million ($1.29 million), a 300% surge on pre-sale estimates.

Read the full story on Jing Daily

Brand Film Pick: Audi Stars in Hit Anime Series on Bilibili

In China, the German auto brand Audi has long been associated with government officialdom, thanks in part to a long-term joint venture between Audi parent Volkswagen Group and First Automobile Works (FAW), China’s largest car manufacturer.

But nowadays premium automakers are all vying for a share of China’s valuable young consumer demographic, and Audi is no exception. In an effort to shake off its staid image and appeal to Gen Z, the brand recently partnered with Bililbili, the video platform of choice among Chinese youth, to run a seamlessly integrated animation within an episode of the streamer’s hit series “Ling Cage: Incarnation” (灵笼).

Audi’s short features characters from the post-apocalyptic anime riding its futuristic AI: Trail concept car, which debuted in 2019. The vehicle careens across a cratered landscape, evading foes in an exciting sequence that is a world away from the typical ride enjoyed by a Chinese official. Following the release of the episode last month, Audi announced that the character seen driving the AI Trail, Bai Yueke, would become the brand’s first virtual automobile owner.

News in English

Does Chinese-style e-commerce livestreaming have what it takes to go global? Here’s a prediction that it will soon transform how consumers around the world shop. Asia Times

But in China, the rise of livestreaming sales has seen increased competition among hosts that is pushing “mom-and-pop” sellers out as a few top names make it big. SCMP

One of the biggest names in Chinese livestreaming, Xinba, plays on his humble background and courts controversy as he sells millions worth of goods on Kuaishou. Week in China

Taylor Swift is participating in Tmall’s Singles’ Day again: The American singer, who performed live in Shanghai as part of last year’s event, pre-recorded a “livestream” session with Viya to promote limited-edition fan merchandise. Radii

Beauty is always one of the biggest categories during Singles’ Day, leading global brands to develop increasingly elaborate digital marketing campaigns. Glossy

Kuaishou filed for an IPO in Hong Kong, as the video platform seeks to raise as much as $5 billion, which would value the company at upwards of $40 billion. Caixin

The prospectus filed by Kuaishou gives an inside look at the tech firm’s operations, including its $1 billion loss during the first six months of 2020. Techcrunch

Meanwhile, rival Bytedance is looking for a valuation of $180 billion as it seeks to raise $2 billion from investors before it pursues its own IPO. Bloomberg

Bytedance is also on a major hiring spree, with plans to hire 10,000 employees in China by the end of this year. Caixin

Tencent has launched a marketing blitz around its return to e-commerce via the “mini shop” feature that it introduced in July to allow brands to set up stores on WeChat. Caixin

China is redefining the concept of C2M (consumer-to-manufacturer) over the past two years thanks to a big push from major tech players such as Alibaba, JD.com, and Pinduoduo. Tech Buzz China

Global brands strutted their stuff at the China International Import Expo in Shanghai, where an 88-carat black diamond was the highlight of the show, though LVMH was notably absent among luxury groups. WWD

The NBA attempted a comeback at the CIIE, a year after the league found itself embroiled in political controversy over Hong Kong’s democracy movement. Sixth Tone

We’ve Got China Covered

China Film Insider: 33rd China Film Golden Rooster Awards Announced Nominees

Jing Daily: How Kering Delivered Its Heritage With Gen-Z Audiences

Jing Culture & Commerce: Museum Computer Network’s Virtual Conference Offers New Thinking for the Digital Age